Global Overview

FOREWORD | REN21 President

In Uruguay, we achieved what many thought impossible: we transformed our power system in less than a decade to run on nearly 100% renewables, half of which come from variable renewables sources like wind and solar. This shift didn't just reduce emissions. It cut energy costs, protected us from global fossil fuel/energy price volatility, expanded energy access to 99.9% of households, and created 50,000 new jobs – 3% of our workforce. But it doesn't end there. My country is now making progress in decarbonizing the industrial sector (where we've already reached 65% renewable energy) and, above all, in electrifying the demand for home heating with heat pumps and with electric mobility. Our experience shows that the energy transition is not a burden, but a foundation for resilience and prosperity. A renewables-based economy is not a theory. It is already working, in my country and in many others.

Yet today, we face a paradox. Now that we know a renewables-based electricity system works – and is often the cheapest option – the transition across the broader energy system is slowing, not accelerating. The power sector has proven that the renewable transformation is both technically feasible and economically viable, offering a blueprint for decarbonising heating, transport and industrial processes.

This is not a technical problem. It is a systemic one. Despite clear evidence from the power sector's success, fossil fuels remain favoured by markets, laws and outdated narratives. We are in the middle of a cultural and political battle, a battle of worldviews, and we need every voice at the table to transform our energy system.

That is why the Renewables Global Status Report (GSR) and REN21 are uniquely important. The GSR brings together facts, trends and real-world insights. It shows what is working, what is missing and what is possible. It connects governments, businesses, researchers and communities around a shared understanding. REN21 adds value not by doing what others do, but by enabling what no one can do alone – being a multi-stakeholder catalyst and building a common agenda.

Ensuring reliable, accessible and resilient renewable energy for all is not just about changing fuels. It's about changing the system. This is not a small adjustment; it's a deep transformation. And to make it happen, we need courage, we need collaboration, and above all, we need clarity. That's what this Global Overview offers: a clear picture, built from real experiences, to help all of us move forward together.

Ramón Méndez Galain

President, REN21

Ramón Méndez Galain

Former Energy Secretary,

UruguayPresident, REN21

FOREWORD | REN21 Executive Director

2024 marked a pivotal moment for renewable energy. The world added over 700 GW of renewable power capacity – the largest annual increase to date. This record growth signals real momentum in the shift to renewables.

But it came against a stark backdrop. For the first full year on record, global temperatures remained above 1.5°C. Wildfires, floods and other climate-driven disasters disrupted lives and energy systems across continents, underscoring the urgent need for systemic change.

Fossil fuels continued to fill part of rising energy demand, pushing CO₂ emissions up by 0.8%. Yet the scale of renewable deployment shows growing capacity to meet global needs, and to shape a different energy future.

Despite policy reversals in some regions, many governments advanced bold renewable strategies. Energy security is now understood as not just fuel supply, but resilience, affordability and infrastructure.

This shift matters. Renewables deliver more than climate benefits: they offer stability, energy sovereignty and economic resilience. The technologies exist. The momentum is here. What's needed now is sustained political will and scaled-up investment.

To unlock the sector's full potential, we must build flexible grids, reform institutions, align sectors and direct finance where it drives real impact. With coordinated structural change, renewables can power resilient, equitable economies.

The Renewables 2025 Global Status Report captures insights from across our global network. It provides decision makers with the tools to act – urgently and at scale.

We thank the REN21 network, our global contributors, and the REN21 Secretariat team. Let us move forward together with purpose, determination, and the resolve to turn momentum into lasting change.

Rana Adib

Executive Director, REN21

Rana Adib

Executive Director, REN21

Introduction

GLOBAL CONTEXT

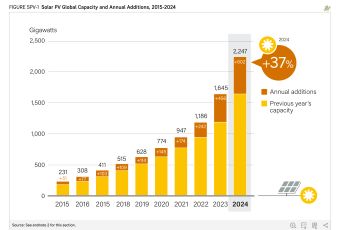

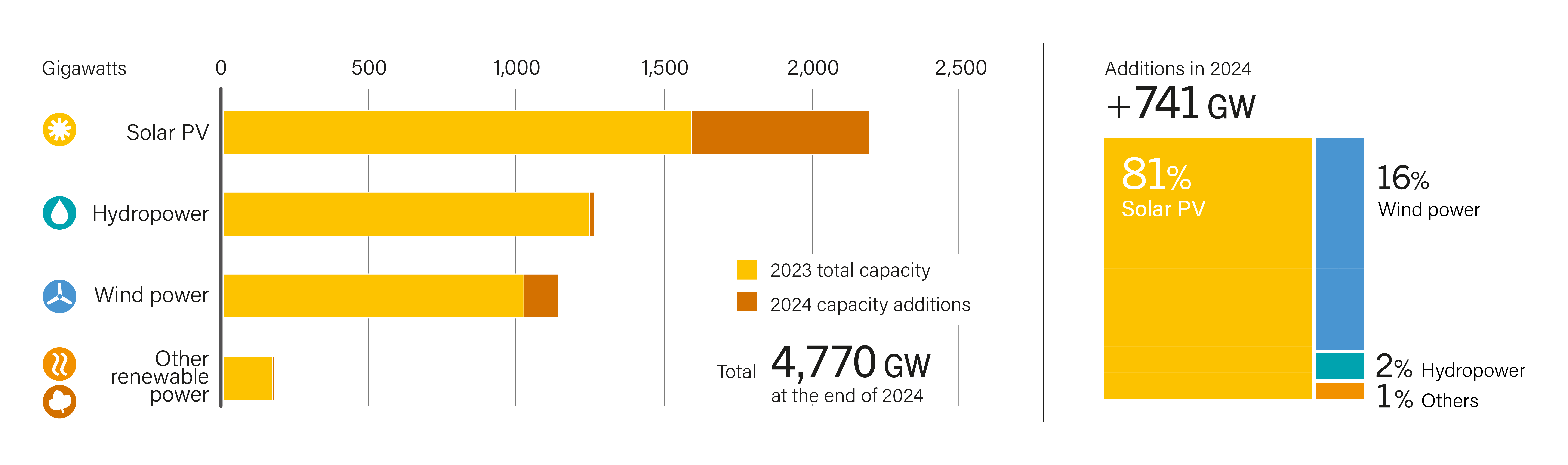

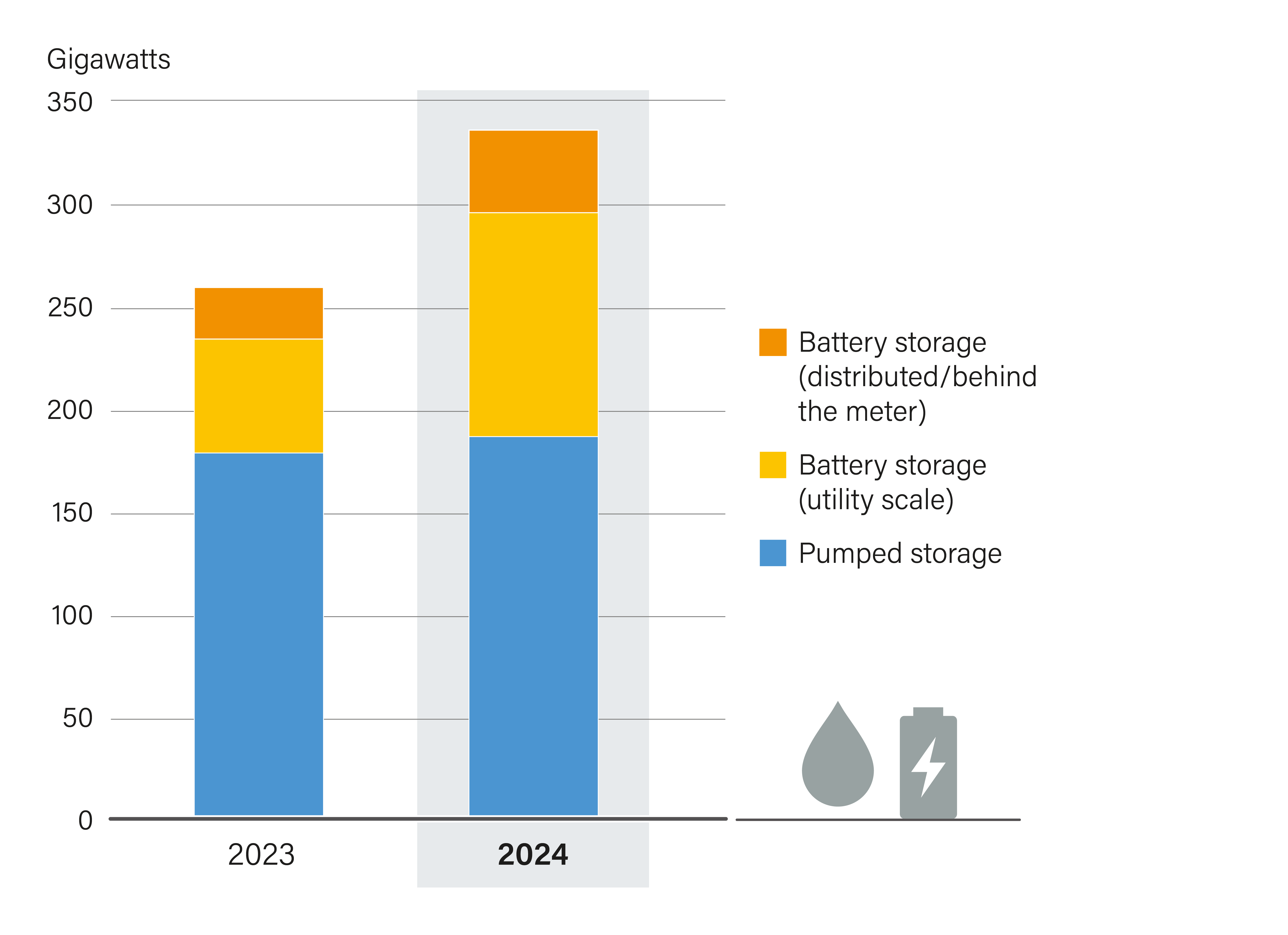

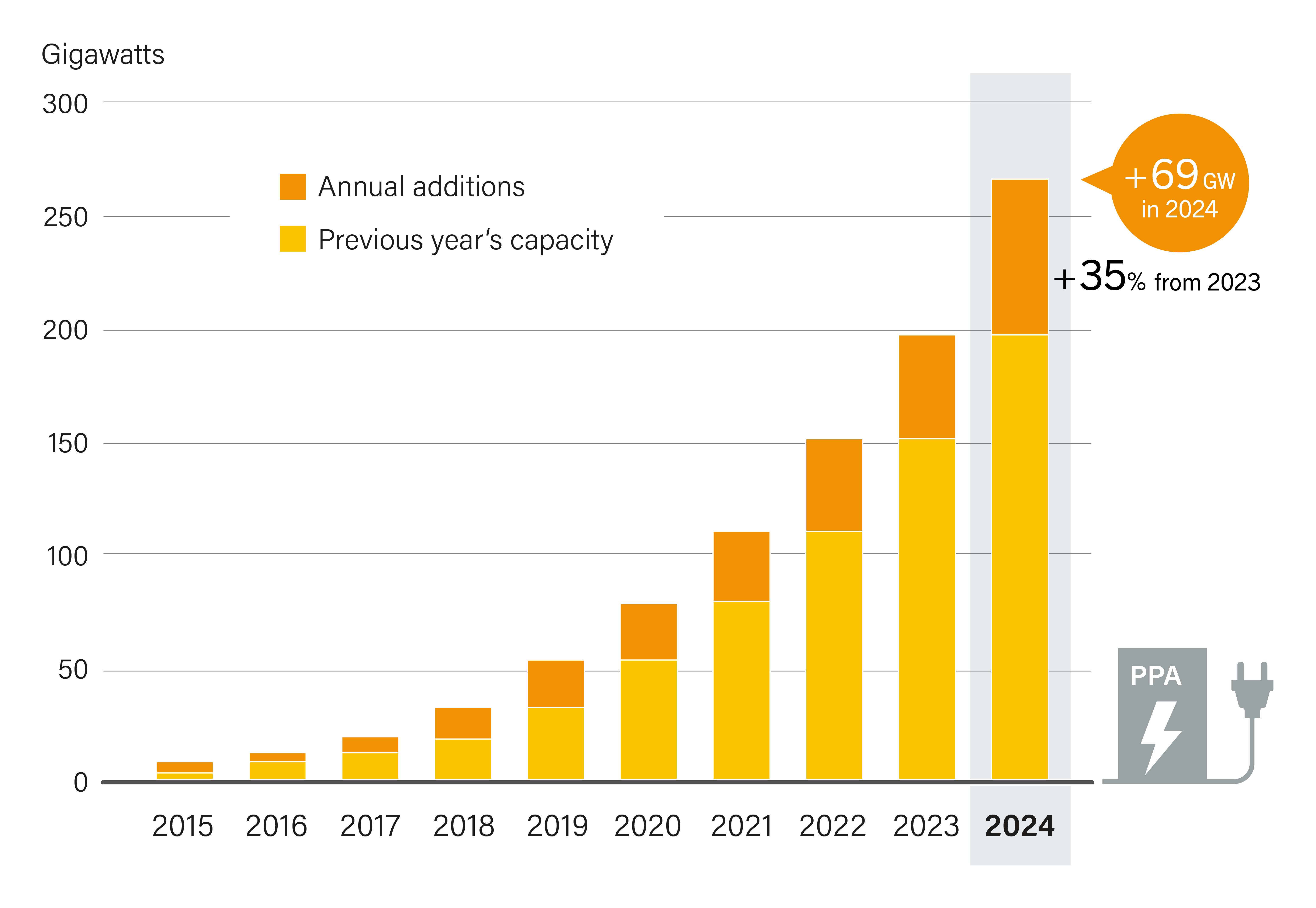

In 2024, global renewable energy growth was primarily driven by the power sector, where capacity expanded by 741 gigawatts (GW), the largest annual increase ever recorded. 1 Solar photovoltaics (PV) led this growth, supported by rapidly falling costs, large-scale deployments and mature supply chains; however, growth in wind energy installations slowed. 2 Deployment of battery storage hit record levels, driven by falling prices and growing recognition of storage as critical for grid reliability. 3 Despite this momentum, renewable energy growth could not keep pace with rising global electricity demand. 4

Growth in electricity demand was driven by higher temperatures, industrial expansion and rapid electrification in emerging markets. 5 Data centres consumed large amounts of electricity as use of artificial intelligence (AI) technologies continued to grow. 6 Renewables were deployed to meet some of this demand, and fossil fuels filled the gap. 7 Global energy-related carbon dioxide (CO₂) emissions increased 0.8% compared to 2023. 8

The year 2024 was the hottest on record, and for the first time the global average temperature exceeded 1.5 degrees Celsius (°C) above pre-industrial levels over a full calendar year. 9 Climate impacts intensified worldwide: Los Angeles (United States) faced severe wildfires, Valencia (Spain) experienced extreme flooding, droughts hit Latin America, and flash floods inundated the Caribbean. 10 These events disrupted communities, economies, and energy systems, with vulnerable regions suffering the most. This series of disasters again emphasises that the climate emergency is not a future threat – it is already disrupting lives and livelihoods across the planet.

Energy security remained in the spotlight in 2024, as geopolitical tensions, trade disruptions and rising economic nationalism influenced national energy strategies. 11 (See Sidebar 1.) Countries sought to secure supply, reduce external dependencies and control prices. While some countries accelerated their investments in renewables and energy storage to reduce risk and increase resilience, fossil fuel investments also grew, often driven by industrial lobbying and short-term security concerns. 12 As these developments underscore, the energy transition is shaped not only by technical and economic factors, but also by political and governance choices, domestic pressures and competing visions of national interest.

Renewable energy is no longer just a climate solution; it is essential infrastructure. In a world of intersecting crises, renewables support sustainable economic development, public health and energy security.

RENEWABLE ENERGY DEVELOPMENTS AND TRENDS

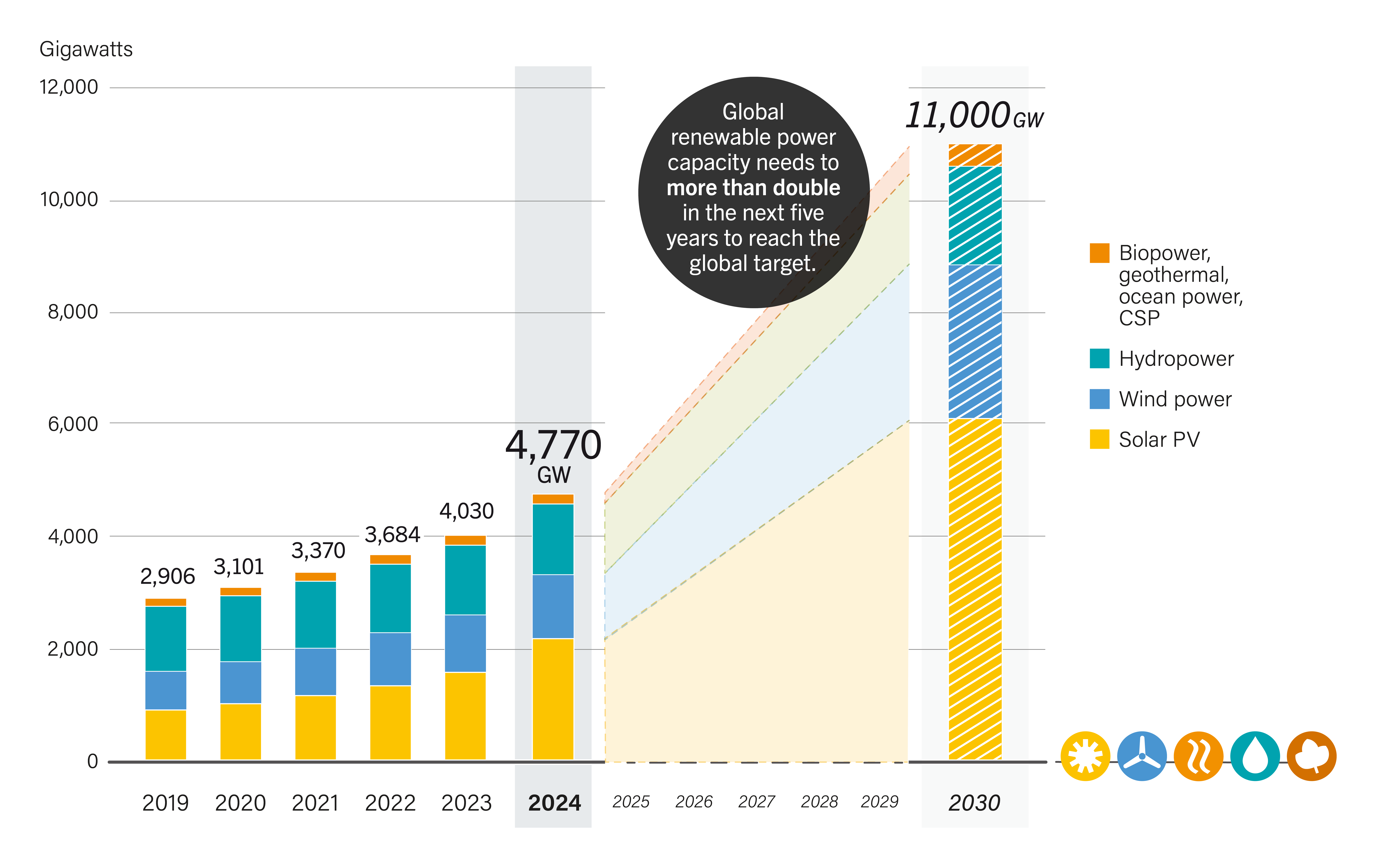

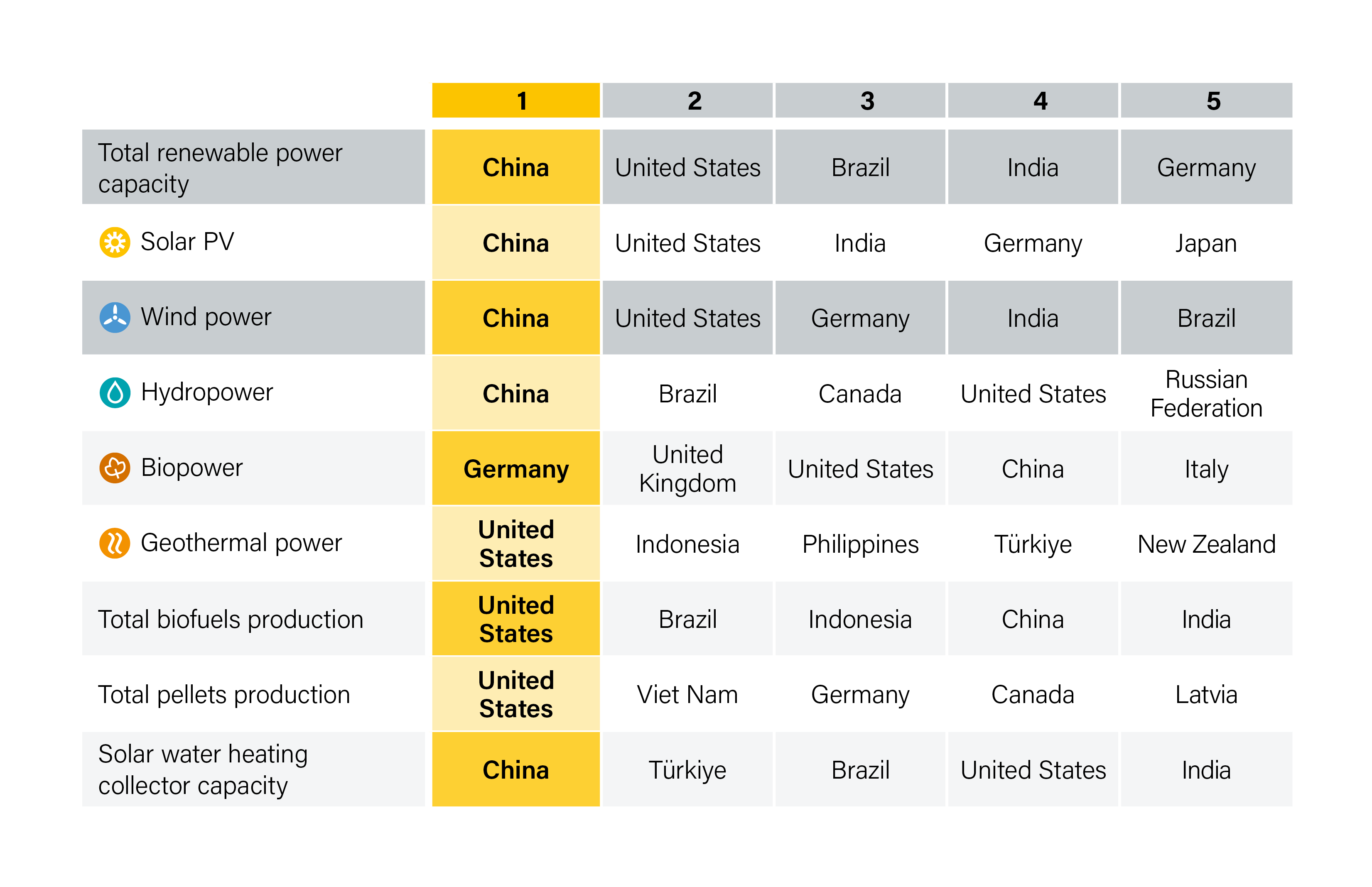

In 2024, global renewable power capacity increased 18%, adding a record-breaking 741 GW. 13 Solar PV was the primary driver, contributing 602 GW and accounting for 81% of the total capacity increase. 14 Wind energy followed, adding 117 GW globally. 15 Other renewable sources – whether for power, heat or transport fuels – accounted for only small additions to the global energy supply. China was the dominant contributor to new renewable power deployment, responsible for 60% of the global total. 16 The Group of Seven (G7) nations accounted for just around 14%. 17 Even at the record growth levels of 2024, projections indicate that the world will fall 800 GW short of the internationally agreed target calling for a tripling of renewable power by 2030. 18

Despite its dominant contribution, the annual growth rate of solar PV power capacity additions fell to 32%, down from 82% in 2023 and 35% in 2022. 19 This slowdown reflects growing challenges, including grid saturation, policy shifts and tighter financing in several key markets. 20 Wind power capacity grew 0.2%. 21 China continued to expand its wind energy capacity, adding 79.8 GW in 2024, whereas additions in other regions slowed significantly. 22

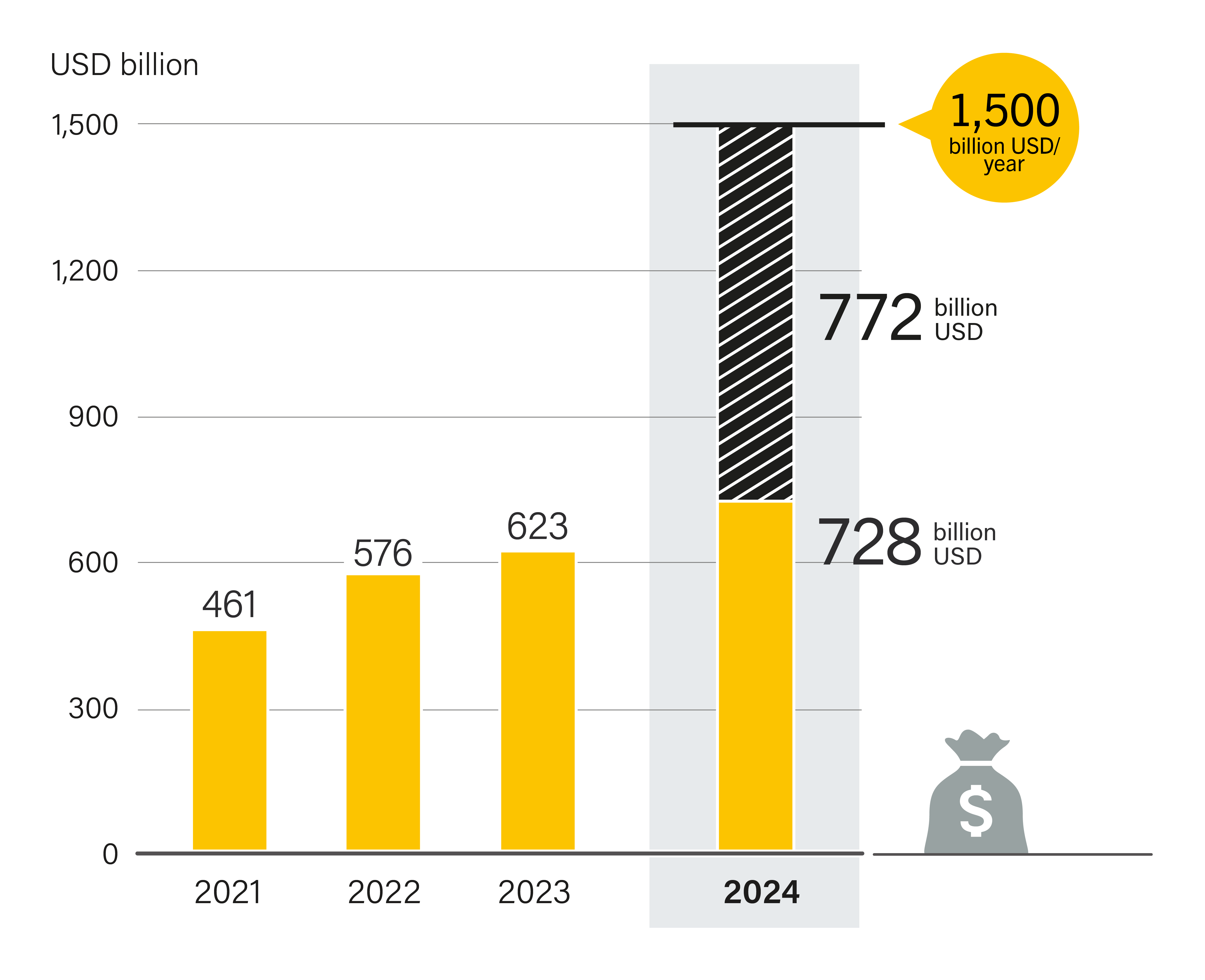

Electricity generation from renewables increased 10% in 2024, doubling the 5% increase seen in 2023. 23 However, this growth was accompanied by a slowing of investment. Total global investment in renewable energy i reached USD 728 billion in 2024, up 8% from the previous year. 24 This was well below the growth rates of 19% in 2023 and 23% in 2022. 25 The main reason for this slowdown was a substantial decline in wind power investment. 26

Electric vehicle sales reached a new record in 2024, with 17 million units sold worldwide. 27 Despite this milestone, the global growth in EV sales slowed to 25%, compared with 34% in 2023 and 55% in 2022. 28 Strong demand in China and other emerging economies was in contrast to modest gains in the United States and a clear slowdown in the European Union (EU). 29 In Europe, the withdrawal of EV purchase subsidies in Germany, combined with the anticipated roll-out of EU-wide CO₂ standards in 2025, led to a cooling of consumer demand. 30 Meanwhile, investment in road transport infrastructure increased 20% to reach USD 757 billion in 2024, exceeding investment in renewables ii . 31 Global investment in heat pumps fell from USD 81.4 billion in 2023 to USD 77.1 billion in 2024, with a slowdown in sales in key markets (especially Europe) due to economic conditions, subsidised fossil fuels and reduced incentives. 32

RENEWABLES IN THE GLOBAL ENERGY SYSTEM

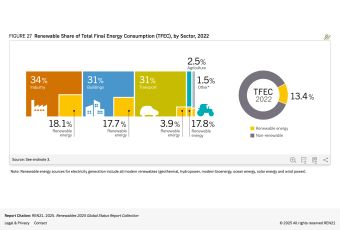

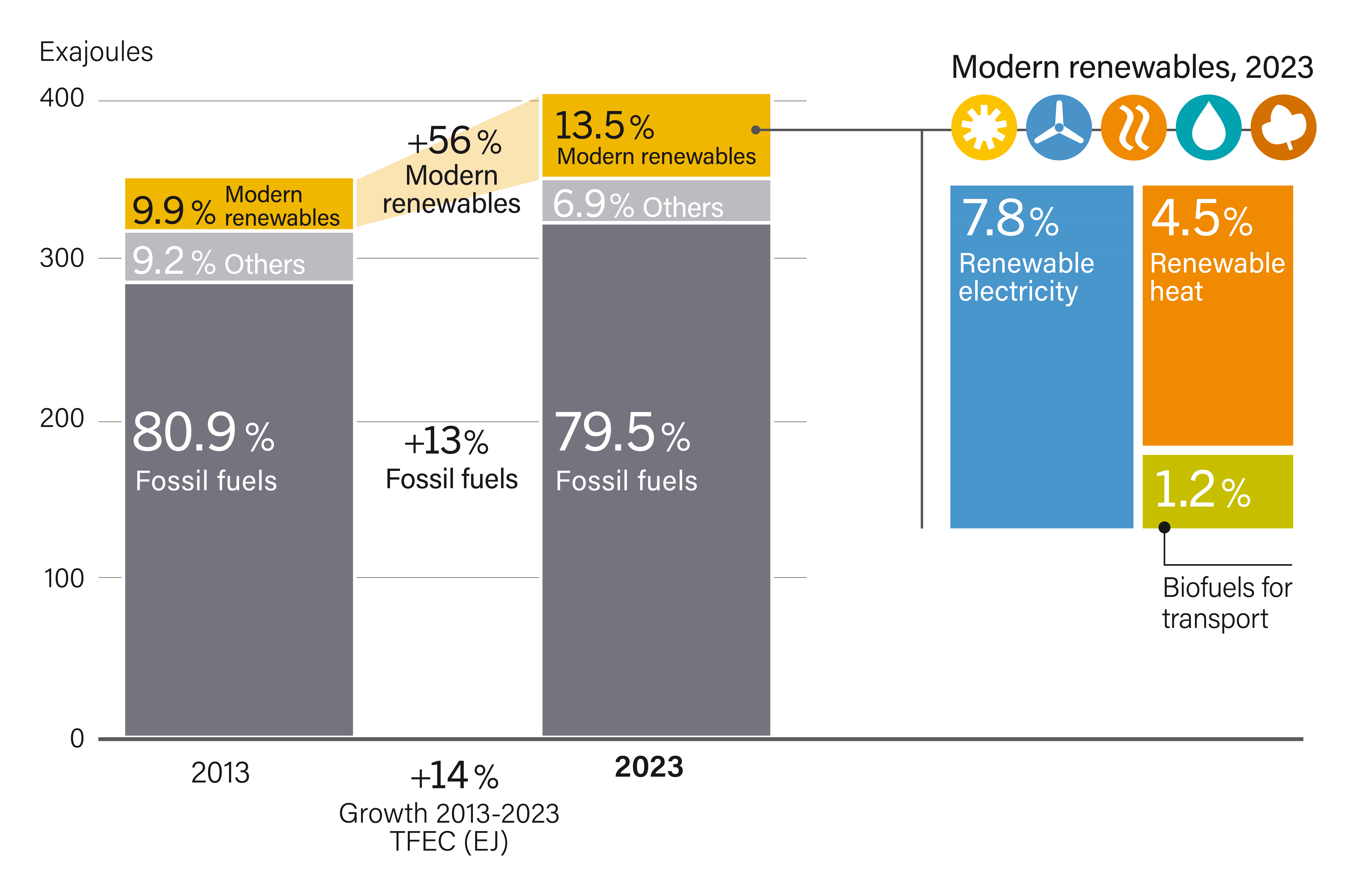

Global energy demand continued to rise in 2023. 33 The increase was reflected across all end-use sectors, as total final energy consumption (TFEC) grew 2.2%. 34 The estimated share of renewable energy in TFEC in 2023 was 13.5%. 35 (See Figure 1.) Industry remained the largest end-use sector, accounting for 34% of total consumption, followed by buildings (31%), transport (31%) and agriculture (2.5%) and other energy uses (1.5%). 36 In 2023, Iceland remained the country with the highest share of renewable energy in TFEC at 83%, owing to hydropower and geothermal; Lao People's Democratic Republic (PDR) (73%) and Gabon (66%) followed, both of which rely heavily on hydropower. 37 (See Figure 2.)

FIGURE 1 Total Final Energy Consumption by Source, 2013 and 2023

Sets of cooling towers in the data center

FIGURE 2 Renewable Share of Total Final Energy Consumption, by Country, 2022

Electricity demand increased 4.3% in 2024, up from growth of 2.5% in 2023 and well above the annual average growth of 2.7% between 2010 and 2023. 38 This increase was driven primarily by rising cooling needs and rapid industrial development in emerging economies. 39 Energy demand also rose in advanced economies, notably in the United States, where the proliferation of infrastructure for data centres created substantial new electricity loads. 40

Renewable capacity additions met two-thirds of the increase in global power demand, while the use of fossil fuels, particularly coal and natural gas, also increased. 41 Electricity from coal reached a global all-time high in 2024, although the growth rate slowed to 0.88% (1.7% in 2023). 42 In total, 44 GW of new coal-fired power capacity was commissioned in 2024, surpassing the 25.2 GW of coal capacity that was retired in the same period. 43

The number of people without access to electricity declined by more than 8 million from over 745 million in 2023 to around 737 million in 2024. 44 Sub-Saharan Africa accounted for the vast majority of the global electricity access gap, with 80% of those without access residing in the region. 45 Achieving Sustainable Development Goal 7.1 – universal electricity access by 2030 – would require the number of people without access to decline at a rate roughly ten times faster than the current pace. 46

Meanwhile, global progress on energy efficiency remained weak at around 1% in 2024. 47 This was unchanged from 2023 and well below the average annual gains of the previous decade. 48 This stagnation is particularly concerning in light of the commitment made at the 2023 United Nations Climate Change Conference in Dubai, United Arab Emirates (COP 28) to double the annual rate of energy efficiency improvement from 2% to 4% by 2030. 49 Gains were led primarily by the United States and the EU, where regulatory frameworks and market incentives helped reduce energy waste across sectors. 50

The insufficient deployment of renewables and slow progress on energy efficiency meant that emissions again increased in 2024, albeit at the slowest rate since the easing of the COVID-19 pandemic in 2021. 51

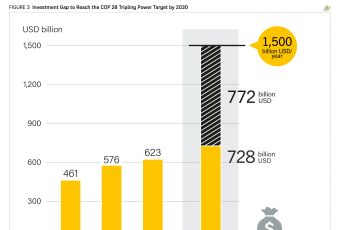

More than 2x investment needed to reach COP28 tripling target.

Several governments and private actors showed evidence of backsliding on climate and energy commitments amid rising trade barriers, grid-related constraints, political shifts and policy changes. 52 In early 2025, the new United States administration announced plans to withdraw once again from the Paris Agreement, promote fossil fuels, and roll back domestic and international support for renewables and climate-related projects. 53 The EU postponed its implementation of stricter CO₂ emission standards that had been scheduled for 2025. 54 New Zealand reversed its ban on offshore oil and fossil gas exploration and withdrew incentives for EVs, although the government also took measures to speed up consenting processes for renewable energy installations. 55

The underlying economics of renewable energy have nonetheless continued to improve, and renewables increasingly outcompete fossil fuel technologies on cost grounds alone. 56 To achieve the internationally agreed target to triple renewable energy power capacity by 2030, an additional USD 772 billion investment will be needed between 2025 and 2030. 57 (See Figure 3.)

FIGURE 3 Investment Gap to Reach the COP 28 Tripling Power Target by 2030

i Data from BloombergNEF classify the following technologies as renewables: biofuels; biomass and waste; geothermal; ocean; small hydropower (between 1-50 MW); solar; and wind.

ii Including EV and fuel-cell vehicle sales and charging infrastructure.

Policy and Commitments

In 2024, policies and commitments on renewables showed uneven progress. Some governments raised ambition through updated targets and supporting policy mechanisms, while others stalled or backtracked. Most policy attention continued to centre on the renewable power sector, with less focus on renewable heating, cooling and renewable fuels i . 1

CLIMATE AND ENERGY COMMITMENTS

Several new international climate and energy commitments were announced in 2024, yet their implementation remained vague. At the 2024 United Nations Climate Change Conference in Baku, Azerbaijan (COP 29), developed countries agreed to triple climate finance for developing nations. 2 The new target is for developed countries to provide USD 300 billion annually, with combined public and private flows expected to reach USD 1.3 trillion per year by 2035. 3 However, this outcome drew criticism from civil society organisations and climate-vulnerable countries — including least developed countries and members of the Alliance of Small Island States (AOSIS) — which argued that the pledges fall short of what is needed in light of escalating climate impacts and the urgent need for adaptation finance. 4 The agreement also lacked clarity on how the funds would be mobilised and allocated. 5

Only 22 countries submitted updated NDCs by May 2025.

The final outcome document of COP 29 did not call for “transitioning away from fossil fuels”, reflecting a step backwards compared to the stronger language adopted a year earlier at COP 28. 6 This omission was seen by many as a setback for global climate policy, and an indication of the ongoing resistance from fossil fuel interests that is weakening the push for co-ordinated phase-out strategies. 7

COP 29 delivered three notable energy pledges:

• A pledge on Green Energy Zones and Corridors – backed by 57 countries, including Belgium, Türkiye, and the United Kingdom, along with non-governmental actors – aims to connect renewable-rich areas with demand centres through large-scale inter-regional grids. 8

• The Global Energy Storage and Grids Pledge, which included commitments from 65 countries, sets collective goals to deploy 1,500 gigawatts (GW) of energy storage, double global grid investment and build 25 million kilometres of new grid infrastructure by 2030. 9

• The Hydrogen Declaration committed 62 countries to scale up green hydrogen production and reduce their reliance on fossil-based hydrogen. 10 Green hydrogen output was less than 1 million tonnes in 2024, compared to 96 million tonnes for fossil-derived hydrogen. 11

The Group of Seven (G7) countries announced a pledge to phase out “unabated” coal power plants between 2030 and 2035. 12 The language left room for interpretation, allowing countries to align with their own pathways towards net zero greenhouse gas emissions, seen as a concession to coal-dependent G7 members such as Germany and Japan. 13 The G7 also remains unlikely to meet its earlier target of eliminating “inefficient” fossil fuel subsidies by 2025. 14 Global subsidies for fossil fuels remained high at USD 1.1 trillion in 2023 ii . 15 Although this was down from the record USD 1.7 trillion in 2022, it remains a major barrier to the energy transition. 16

Global subsidies for fossil fuels remained high at 1.1 USD trillion in 2023.

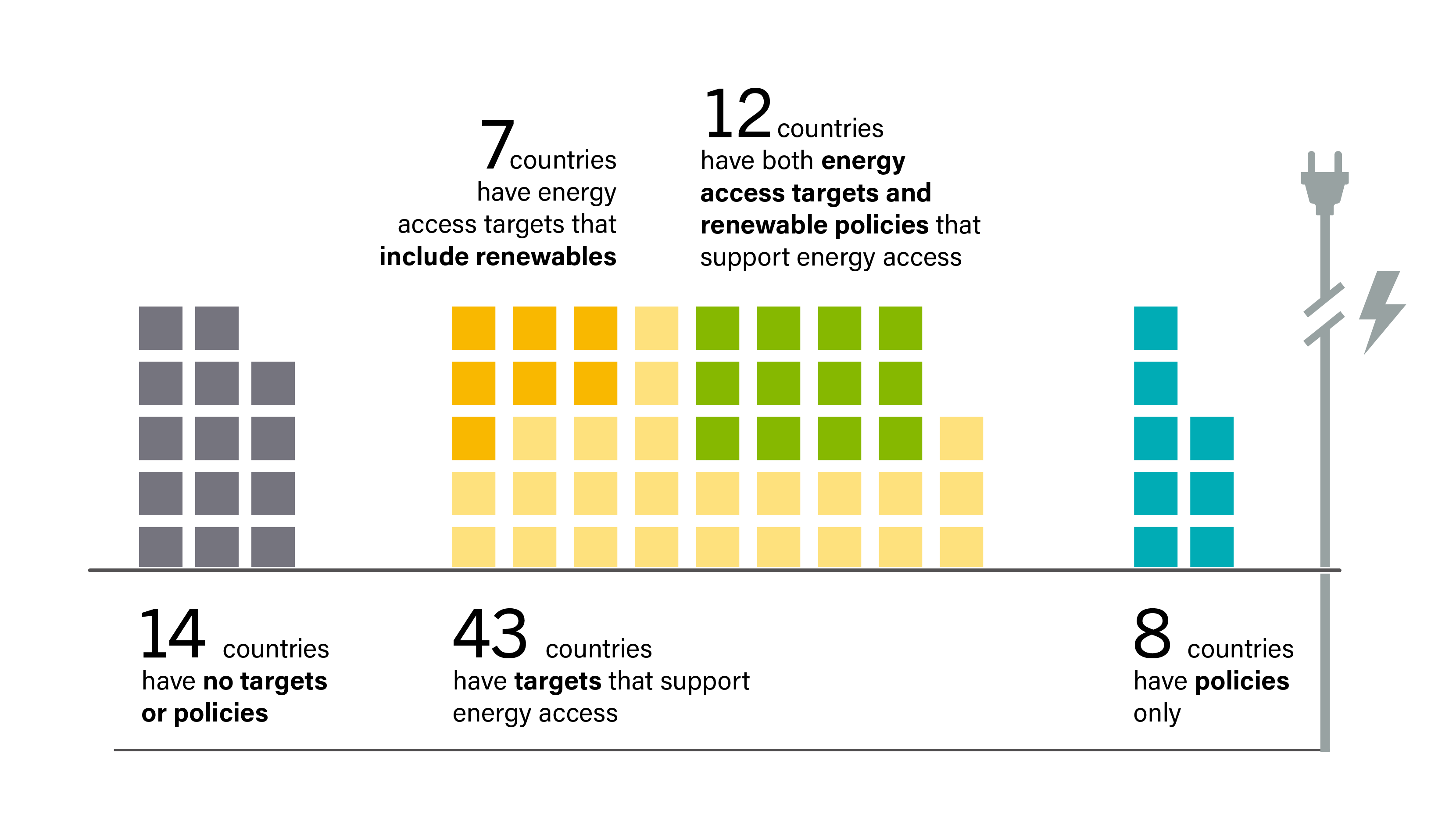

Whereas international-level pledges help set the tone for global ambition, national commitments determine whether this ambition translates into tangible progress. This is particularly evident in the case of energy access. An estimated 737 million people worldwide still lacked access to electricity as of 2024. 17 Current improvement rates remain far below what is needed to meet the target for universal electricity access by 2030, set in Sustainable Development Goal (SDG) 7.1. 18 While some governments have adopted national energy access targets in line with SDG 7, underpinned by renewable energy strategies, many fall short on implementation and financing. 19 (See Sidebar 2.).

As of May 2025, of the 195 Parties that had signed the Paris Agreement, 180 had submitted at least one set of Nationally Determined Contributions (NDCs) in the decade since 2015. 20 However, only 22 countries (together contributing just 21% of global greenhouse gas emissions) had submitted their updated NDCs iii , which include climate targets for 2025-2035. 21

Changes in government, leadership or political priorities led several countries to reverse or delay overall climate measures in 2024. 22 Just 13 countries met the NDC submission deadline of 10 February 2025, and several major emitters missed the deadline. 23 However, all 22 of the updated NDCs submitted by May 2025 referred to renewable energy as a means to support climate mitigation and/or adaptation. 24

As of 2024, 53 countries had carbon pricing policies in place and 45 countries had both net zero emission targets and carbon pricing policies – including carbon taxes and emission trading systems (ETS). 25 (See Figure 5.) However, many of the existing carbon pricing policies cover only a small share of national emissions, or just one end-use sector: 51 countries covered emissions from industry, and 45 countries covered emissions from transport (including aviation), yet only 23 countries covered emissions from buildings and only 17 countries covered emissions from the agricultural sector. 26

As of 2024, 44 countries, including all EU Member States, had established emission trading systems. 27 Only two new countries initiated national carbon pricing frameworks during the year: Pakistan, through the adoption of its National Carbon Market Policy, and Brazil, where the Congress approved a framework law to establish a national ETS. 28 A total of 31 countries had carbon taxes in place in 2024, with no new policies enacted during the year; carbon tax rates ranged from less than USD 1 to USD 167 per tonne of CO2 or CO2 equivalent. 29 Uruguay had the highest carbon tax rate at USD 167 per tonne of CO2 equivalent, followed by Switzerland and Liechtenstein (both with USD 132 per tonne of CO2 iv ). 30

FIGURE 5 Countries with Enacted Climate Change Policies, by Type of Measure, as of 2024

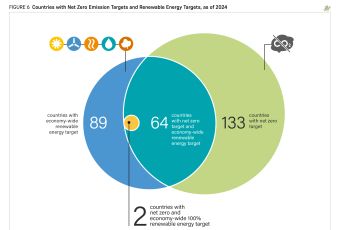

As many as 90 countries had in place targets for net zero greenhouse gas emissions as of 2024, and 68 of these countries set 2050 as the target year. 31 Cabo Verde had the most ambitious target, with 2025 as the target year, followed by Dominica, Liechtenstein, Maldives and Uzbekistan (all with 2030 as the target year). 32 Uganda and Thailand had among the longest timelines for reaching net zero emissions, targeting 2065, and India set its target year to 2070. 33 Additionally, 43 further countries had a net zero target that was proposed or declared only by 2024, but not yet fully enacted. 34 Most policies outlining net zero emission targets include renewable energy as a core feature. 35

Solar PV in Fiji

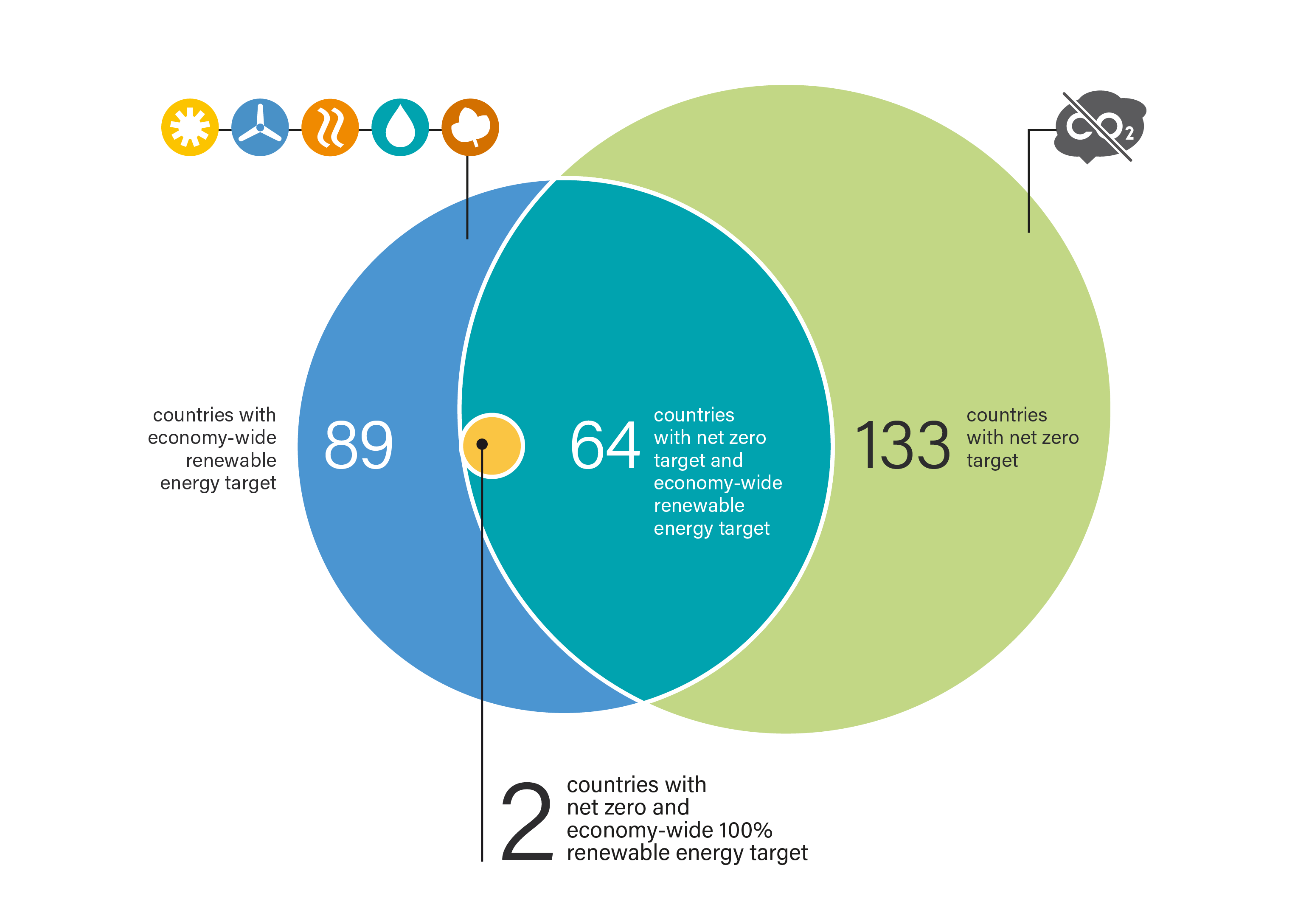

89 countries had economy-wide renewable energy targets in 2024, while 133 countries had net-zero targets.

Meanwhile, as of 2024, 89 countries had enacted economy-wide renewable energy targets, and 64 countries had both net zero emission and economy-wide renewable energy targets. 36 (See Figure 6.) Only two countries had both net zero emission and 100% economy-wide renewable energy targets. 37 These two countries were Fiji and Nauru, both developing countries that are particularly vulnerable to climate impacts. 38

Despite continued global commitment and the growing number of net zero emission targets, setbacks have become apparent. Scotland, for example, eliminated its 2030 climate targets because they were considered to be unachievable, but kept in place targets for 2045. 39 Such revisions to near-term climate targets and delays in updating targets, combined with political and regulatory uncertainties, have continued to undermine implementation, increasingly affecting investor confidence. 40 Relatedly, the private sector sent mixed signals in 2024, with some new initiatives but also signs of backtracking among key actors. 41 (See Sidebar 3).

FIGURE 6 Countries with Net Zero Emission Targets and Renewable Energy Targets, as of 2024

RENEWABLE ENERGY TARGETS

Renewable energy targets are formal commitments that define clear goals to increase renewable energy within a set time frame, guiding policies and investments to drive uptake. 42 Showing little growth since 2023, 89 economy-wide renewable energy targets were in place in 2024, ranging from a 10.6% renewables share in Malta's energy supply to 100% renewable shares planned in Barbados, Comoros and Fiji by 2030. 43 Economy-wide renewable energy targets for 2050 ranged from 31% in Indonesia to 100% in the Philippines. 44

Six countries had targets for 100% renewables as of 2024: Barbados, Comoros, Fiji, Guyana, Nauru, and the Philippines, most of which are small island developing states (SIDS). 45 This reflects the high ambition on renewable energy among some of the countries that are most exposed to the impacts of climate change. 46

Indonesia, however, lowered its 2025 renewable energy target from 23% to between 17% and 19%. 47 In early 2025, the EU announced that it is far behind its 2030 renewable energy target of at least 42.5% and highlighted the need for accelerated efforts, with renewables making up only 24.5% of the EU energy mix in 2023. 48

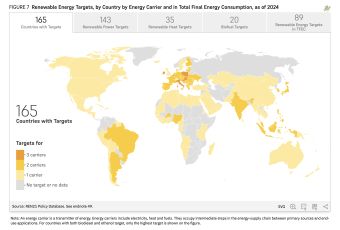

Moreover, several specific targets were in place to support an increase in renewable energy supply across electricity, direct thermal energy (heat) and fuels in 2024. By year's end, 287 renewable energy targets across energy carriers were in place in 162 countries. 49 (See Figure 7.)

Additionally, 143 countries had in place renewable electricity targets as of 2024, ranging from a 10% target for 2030 in Ghana to 100% targets for 2030 in Barbados, Denmark, Kenya, and Tuvalu, among other countries. 50 A total of 35 countries had targets for direct renewable heat (thermal energy), ranging from 7% by 2030 in Georgia to 67.5% by 2030 in Lithuania. 51 Twenty countries had in place renewable fuel targets in 2024, mostly biofuel blending mandates, ranging from 7% by 2030 in the Netherlands to 34% by 2030 in Finland. 52 The uneven distribution across renewable power, heat and fuel targets shows that renewable energy policy attention remains concentrated on the power sector, with limited focus on renewable heat and fuels.

As of 2024, only nine countries had targets for all mentioned renewable energy carriers , all in the EU. 53 Most countries (83) had a target in place for only one renewable energy carrier. 54 Only Romania enacted a new economy-wide renewable energy target during the year; only the Czech Republic, Ukraine and Uzbekistan enacted new renewable power targets; and only Cambodia and Poland announced new renewable power targets. 55 Both Montenegro and Ukraine enacted renewable heat targets, while Slovenia announced a renewable heat target. 56 Revised, more ambitious biofuel targets were announced and/or enacted in Japan, the Philippines and Poland in 2024. 57

FIGURE 7 Renewable Energy Targets, by Country by Energy Carrier and in Total Final Energy Consumption, as of 2024

Despite the global goal set at COP 28 to triple the world's renewable power capacity by 2030, existing national plans and targets are projected to deliver only half of the necessary expansion. 58 This translates to a projected shortfall of 3.8 terawatts, or 34%, based on existing policy trajectories. 59 Of the major renewable energy technologies, only solar PV is on track to meet the required levels of growth. 60 Supported by more robust policy implementation, deployment of all other renewable technologies will need to accelerate substantially to contribute meaningfully to global goals. 61

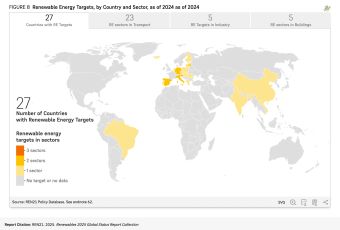

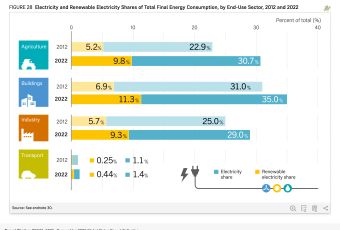

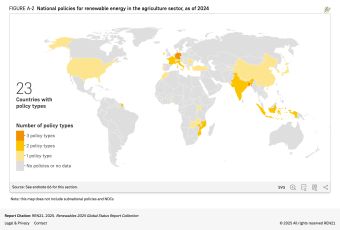

In 2024, targets continued to play a central role in driving renewable energy consumption in end-use sectors. However, whereas 89 countries had economy-wide renewable energy targets in 2024, only 27 countries had sectoral targets for renewables during the year. 62 (See Figure 8.) This included 23 countries with targets for renewable energy shares in the transport sector, with 2030 targets ranging from 13.4% in Greece and 14% in Estonia and Hungary to 40% in China and Iceland. 63 Five countries had renewable energy targets for buildings in 2024, ranging from 50% in Viet Nam to 68% in Latvia, both set for 2030. 64 Equally, five countries had targets for industry, ranging from 27% by 2030 in Italy to 64.9% by 2030 in Latvia. 65 No renewable energy targets were in place in the agricultural sector in 2024, indicating uneven policy attention across sectors. 66

FIGURE 8 Renewable Energy Targets, by Country and Sector, as of 2024

Only a few new sectoral targets were enacted in 2024, including Latvia's target for nearly 65% renewables in industrial energy consumption by 2030. 67 In the buildings sector, Germany enacted a new renewable energy target based on its Building Energy Act, which requires newly installed heating systems to use 65% renewables. 68 Meanwhile, seven countries enacted new renewable energy targets in the transport sector in 2024 (ranging from 15% to 30% renewable shares); all of these countries were EU Member States, which enacted the targets as part of the 2024 updates to their 10-year national energy and climate plans for 2021-2030. 69

Mokrice hydropower plant near Brezice, Slovenia

POLICY MECHANISMS

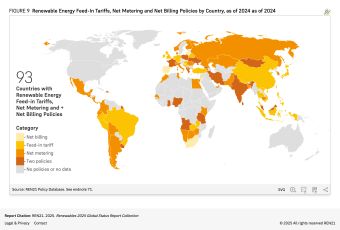

Beyond setting national targets, governments use various policy tools to stimulate renewable energy demand and guide progress towards achieving ambitions. These include feed-in tariffs (FITs), net metering and net billing, auctions and tenders, mandates such as renewable portfolio standards (RPS), and hybrid system incentives. 70

Net metering was the leading policy tool in 2024, in place in 61 countries, including 19 that combined it with feed-in tariffs.

Policies such as feed-in tariffs, net metering and net billing v , which create incentives for renewable energy producers and help facilitate their participation in the energy system, received continued policy attention in 2024. During the year, 116 of these policies were in place across 93 countries. 71 (See Figure 9.) This included 44 countries with feed-in tariffs, 61 countries with net metering policies, and 11 countries with net billing policies. 72 23 countries implemented feed-in tariffs alongside other support mechanisms; among them, 19 combined feed-in tariffs with net metering, while four (France, Greece, Moldova, and Poland) combined feed-in tariffs with net billing policies. 73

FIGURE 9 Renewable Energy Feed-In Tariffs, Net Metering and Net Billing Policies by Country, as of 2024

Several new incentive policies were announced and enacted in 2024, with five countries – Greece, Japan, the Netherlands, Poland and Ukraine – announcing and enacting new feed-in tariffs. 74 In a further five countries – Bosnia and Herzegovina, Cyprus, Denmark, North Macedonia and the United Kingdom – feed-in tariff schemes were closed to new applicants, but existing contracts remained in force. 75 Four countries – Greece, Jamaica, South Africa and Spain – enacted new net billing schemes, and Lithuania shifted from net metering to net billing in 2024. 76 In total, six countries have transitioned from net metering to net billing in recent years: Jamaica, Latvia, Lithuania, Portugal, South Africa and Spain. 77 Cambodia and Malaysia enacted new net metering schemes in 2024. 78

Policy efforts in 2024 increasingly focused on accelerating project permitting and enhancing renewable electricity integration into the electric grid, reflecting the growing global ambition to improve grid and storage infrastructure, a key barrier to the deployment of renewable power capacity in recent years. 79 (See Energy Systems and Infrastructure section.) The increase in hybrid solar-wind systems in India provides a clear example of how hybrid system incentives can drive the uptake of renewables while enhancing grid integration. 80 (See Snapshot India).

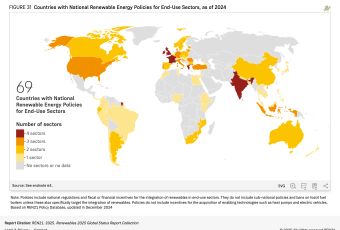

Although only 27 countries had sectoral targets for renewables in 2024, 68 countries had regulations or incentives for renewables in end-use sectors.

Besides policies that support the increase of renewable energy supply, 69 countries had regulations and fiscal or financial incentives targeting end-use sectors in place in 2024. 81 Out of these, only five countries addressed all four major end-use sectors, reflecting a lack of cross-sectoral approaches to the uptake of renewables. 82 Policies mandating biofuel blending in transport, as well as subsidies, rebates and tax exemptions that encouraged the integration of renewable energy systems in buildings, continued to be primary drivers for increasing renewable energy use in end-use sectors. 83 Agriculture and industry garnered less policy attention. 84 (See Renewables in Energy Demand section.)

Eight countries adopted new policy measures to support renewables in the buildings sector in 2024, and most of them were subsidies for rooftop solar PV. 85 Six countries – Austria, Belgium, Brazil, France, Norway and Poland– introduced new transport sector policies, primarily implementing new biofuel blending mandates or tax exemptions. 86 Canada, China, France, India and Slovenia implemented mechanisms to encourage renewable energy uptake in the industrial sector, including subsidies and tenders. 87 Italy, Morocco and Portugal launched subsidy schemes for the agricultural sector in 2024, supporting agrivoltaics and solar pumping kits. 88

In 2024 and early 2025, some policies promoting renewable energy adoption were rolled back, including the incoming US administration's reversal of a 2024 rule that had reduced fees by approximately 80% for wind and solar projects on federal lands. 89 At the same time, fossil fuel bans were repealed or relaxed across different sectors, indicating a retreat from climate and renewable energy commitments. New Zealand lifted its ban on offshore oil and fossil gas exploration and removed incentives for electric vehicles. 90 In early 2025, the United Kingdom announced it would abandon its plan to ban the sale of new gas boilers by 2035, a policy initially introduced by the previous Conservative administration to reduce carbon emissions from home heating. 91 Few governments have enacted their announced bans on internal combustion engine (ICE) vehicle sales, and several have scaled back or delayed these plans, such as the EU allowing ICE cars with CO2-neutral fuels beyond 2035. 92

Trade policies related to renewable energy and enabling technologies have increased sharply in recent years. 93 In 2015, only nine formal trade measures related to renewables and enabling technologies were in place; by 2024, this number had surged to 212, doubling from 2022 and including measures related to solar PV (more than 50 policies), battery components (more than 50), electric vehicles (47), wind turbines (32) and heat pumps (16). 94 Nearly 40% of new trade policies since 2020 involved tariff changes, anti-dumping measures and countervailing duties, while half of energy-related critical minerals are regulated by export controls. 95 Over the same period, around 50 new free trade agreements were signed, most of them maintaining preferential tariffs for renewables and enabling technologies. 96

Snapshot India

Hybrid solar and wind energy systems surging

In the first half of 2024, hybrid solar PV and onshore wind energy systems represented 40% of the total awarded renewable energy capacity in India. These systems involve the co-location of solar PV, onshore wind and often battery storage technologies. They are attractive for electricity utilities and corporate buyers of power purchase agreements because they help reduce the variability in electricity generation and facilitate the integration of renewables into the grid.

According to the International Energy Agency, India is a pioneer in promoting hybrid renewable power plants and can provide useful lessons for other countries seeking to minimise the impacts of variable renewable energy on their electricity network infrastructure. The overall awarded capacity for hybrid systems in India more than doubled from around 5 GW in 2023 to around 12 GW in just the first half of 2024. This represents a significant acceleration in annual growth following the launch of a solar-wind hybrid policy in 2018 by India's Ministry of New and Renewable Energy.

The goal of the policy was to establish a framework to promote large-scale, grid-connected wind-solar PV hybrid systems and to provide incentives to developers. Solar-wind hybrid systems have numerous benefits, including:

efficient use of transmission infrastructure and land;

increased capacity utilisation factors (CUF) compared to stand-alone solar PV and onshore wind plants;

lower variability in generation due to complementary generation profiles (i.e., generating electricity from solar during the day and from wind at night); and

cost-competitive tariffs compared to stand-alone wind power systems.

Hybrid solar-wind systems represented 40% of the total awarded renewables capacity in India in the first half of 2024.

India's solar-wind hybrid policy also permits the use of battery storage to provide more reliable and balanced power output. Several state governments in India have announced their own policies and incentives to promote hybrid projects. A study from Ember found that the tariff rates for hybrid projects in India range in between those for solar and wind projects.

For a 1,350 megawatt (MW) auctioned wind capacity (closed bidding), tariffs were in the range of INR 3.60-3.70 (USD 0.042-0.043) per kilowatt-hour (kWh), with a minimum CUF requirement of 22%.

For a 1,200 MW auctioned wind-solar hybrid capacity, discovered tariffs were in the range of INR 3.43-3.46 (USD 0.040-0.041) per kWh, with a minimum CUF requirement of 30%.

For a 1,200 MW auctioned solar capacity, discovered tariffs were INR 2.48 (USD 0.029) per kWh, with a minimum CUF requirement of 17%.

In India, hybrid projects with battery storage or with firm and dispatchable renewable energy commitments have higher tariffs in the range of INR 3.5-5.6 (USD 0.041-0.066) per kWh. The falling prices of batteries are expected to drive down the cost of these hybrid systems. Meanwhile, higher tariffs through the integration of battery storage will need to be weighed against the benefits of more reliable and balanced output.

Key challenges faced in installing hybrid systems include land constraints (given that many of India's high-potential wind sites have been saturated), grid integration challenges and the lack of a skilled workforce to execute the systems. Despite these constraints, hybrid systems are expected to grow further, with estimates of 30 GW of projects in the pipeline in India as of September 2024.

Source: See endnote 80 for this section.

i Net metering typically credits surplus electricity at the full retail rate, offsetting consumption on a one-to-one basis, whereas net billing compensates exports at a lower rate – such as the wholesale or avoided cost – and separates billing for consumption and generation.

ii The data in this section draw from the REN21 Policy Database. Developed and regularly updated by REN21, the database tracks renewable energy targets and policies across sectors and policy types, primarily at the national level, to support the analysis of ambition and implementation. The REN21 Policy Database is currently being expanded to enhance coverage across governance levels (including sub-national levels) and end-use sectors.

iii Global subsidies for fossil fuels include the fiscal cost of support for fossil fuels through three support mechanisms: direct transfers, tax expenditures, and price support, based on combined data from the Organisation for Economic Co-operation and Development (OECD) and the International Energy Agency.

vi To qualify as a new submission in the 2025 round, an NDC must define its contribution with a 2035 time frame. Countries that submitted their 2025 NDC updates by May 2025 were: Andorra, Brazil, Canada, Cuba, Ecuador, Japan, Kenya, Maldives, Marshall Islands, Montenegro, Nepal, New Zealand, the Republic of Moldova, Saint Lucia, Singapore, Switzerland, the United Kingdom, the United Arab Emirates, Uruguay, the United States, Zambia and Zimbabwe.

v Other countries with relatively high carbon tax rates in 2024 included Sweden (USD 127 per tonne of CO2), Norway (USD 108 per tonne of CO2 equivalent) and Finland (USD 100 per tonne of CO2). The lowest carbon tax rates in 2024 were in Japan (USD 1.91 per tonne of CO2), Argentina (USD 0.81 per tonne of CO2 equivalent) and Ukraine (0.77 per tonne of CO2).See endnote 30.

Investment and Finance

Renewable Energy

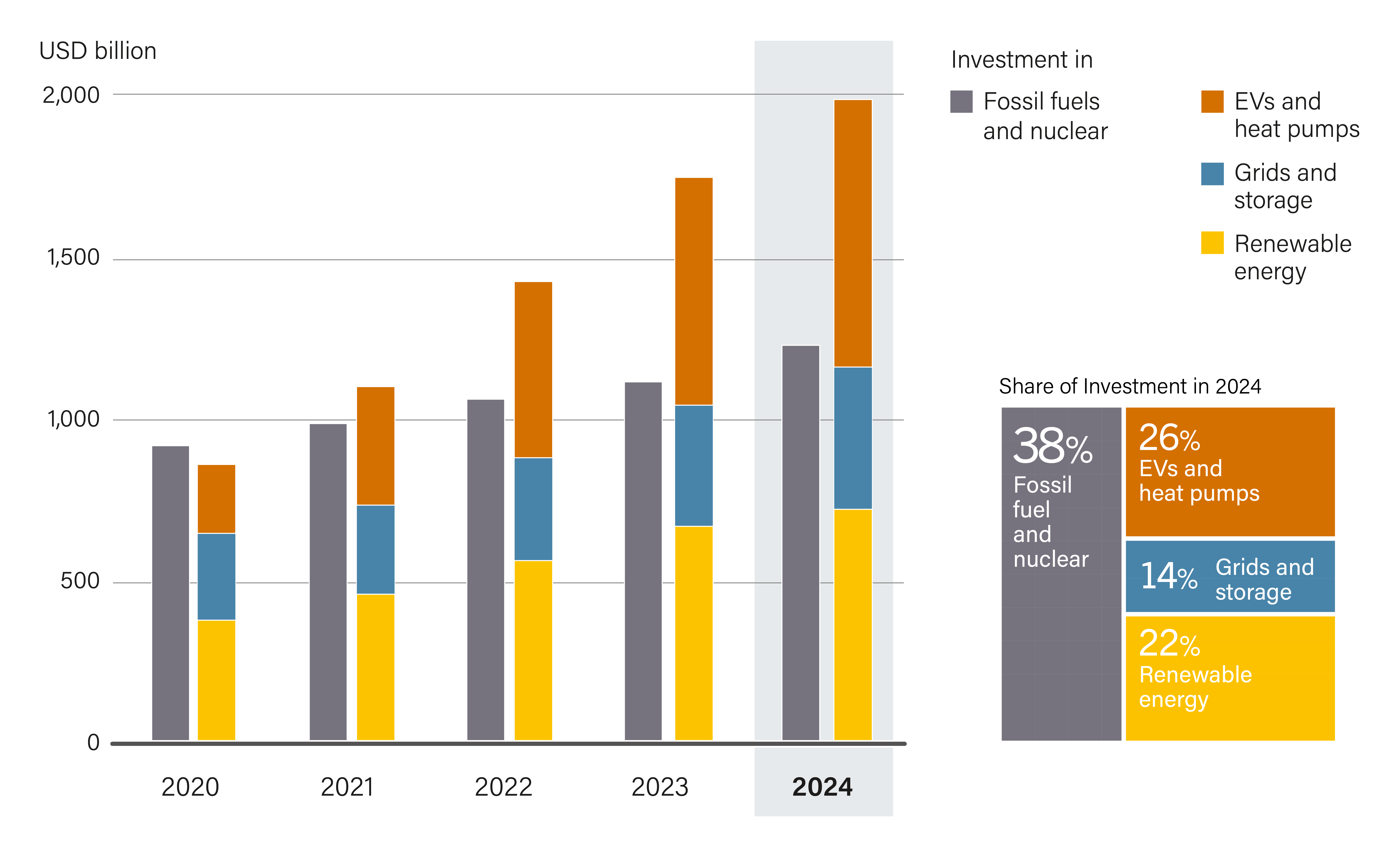

In 2024, global investment in renewable energy and enabling technologies reached a record USD 2.1 trillion, an 13% increase from the previous year. 1 Of this, renewable energy investment amounted to USD 728 billion, up 8% for the year but below the double-digit growth rates of 2023 (19%) and 2022 (23%). 2 Much of the overall investment continued to be in solar power and electric vehicles, highlighting a funding imbalance across the technologies. Global investment in renewables remains well short of what is needed. At just 48% of the annual investment level required through 2030, the world remains off track to reach net zero greenhouse gas emissions by 2050. 3

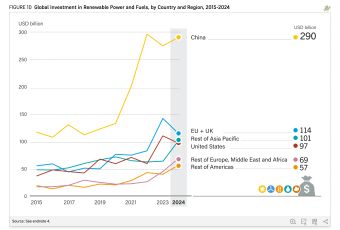

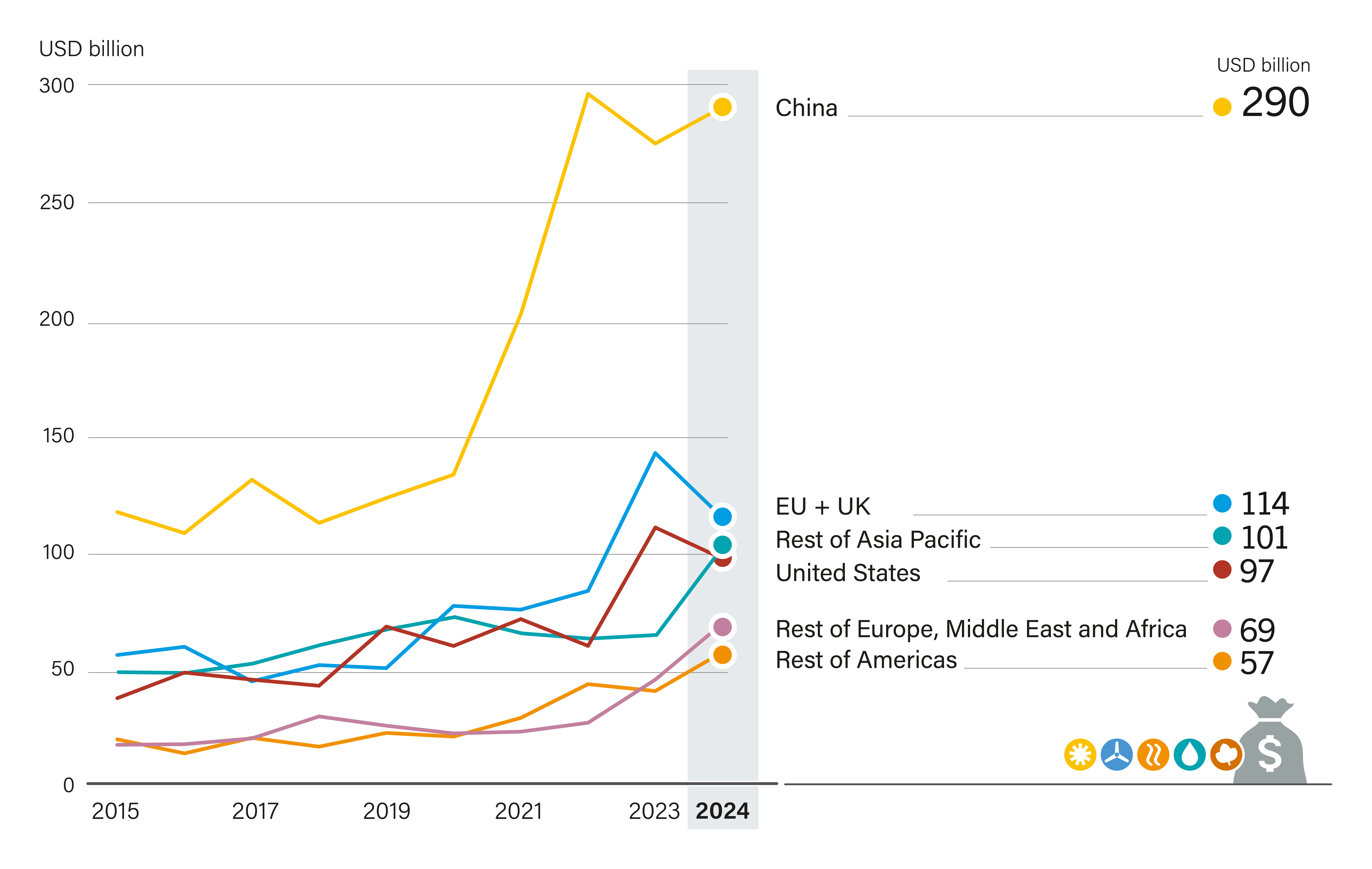

Regional trends in renewable energy investment reveal significant disparities. 4 (See Figure 10.) Between 2015 and 2024, China consistently led global renewable energy investment, peaking at over USD 290 billion in 2024 and accounting for the largest share each year. 5 Investment in the European Union (EU) and the United Kingdom surged in 2023 but dropped significantly in 2024, falling from USD 142 billion to USD 114 billion. 6 Similarly, US investment peaked at USD 110 billion in 2023 before declining to around USD 97 billion in 2024, while growth in the rest of Asia, Africa and the Middle East continued to accelerate. 7

FIGURE 10 Global Investment in Renewable Power and Fuels, by Country and Region, 2015-2024

Despite the strong emphasis on industrial policy support, spending on renewable energy and enabling technologies supply chains fell slightly from USD 145 billion in 2023 to USD 140 billion in 2024. 8 This decline reflects growing caution in the market, particularly within the solar photovoltaic (PV) sector, where oversupply has become a critical issue. 9 Global solar PV manufacturing capacity was expected to surpass 1,100 gigawatts (GW) by the end of 2024 – more than double the current demand. 10 As a result, module prices have more than halved since early 2023, pushing many solar PV manufacturers into negative net margins. 11 These challenging conditions have led to the cancellation of around 300 GW of planned polysilicon manufacturing capacity and 200 GW of wafer manufacturing projects, representing an estimated USD 25 billion in lost investment. 12

728USD billion total investment in renewable power and fuels in 2024.

A significant barrier to accelerating renewable energy deployment in emerging and developing economies is the persistently high cost of capital. 13 For utility-scale solar PV and wind energy projects, the weighted average cost of capital in these regions is often more than twice that in advanced economies. 14 (See Figure 11.) This disparity arises from factors including political and economic instability, currency risks, and underdeveloped financial markets, which collectively elevate the perceived investment risk. 15 Consequently, financing costs constitute a substantial portion of the levelised cost of electricity in these countries, making renewable energy projects less financially viable and hindering their implementation. 16

FIGURE 11 Weighted Average Cost of Capital for Onshore Wind Power and Solar PV, by Country Income Level, 2022-2024

Reducing the cost of capital in emerging and developing economies can greatly lower the overall financing costs of renewable energy projects. 17 A one percentage point reduction in the cost of capital could reduce the financing cost of achieving net zero by USD 150 billion per year. 18 In countries such as Kenya and Senegal, high interest rates and currency risks make financing renewable energy much more expensive than in advanced economies. 19 Without targeted policy and financial interventions, such regions risk being left behind in the global energy transition. 20

72% was the share of solar PV of global renewable investment in 2024.

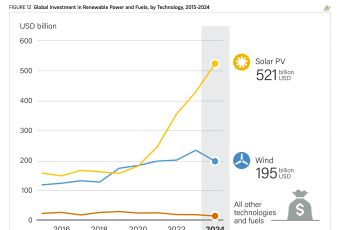

Technology-specific trends reveal a mixed picture. 21 Annual investment in solar PV surged 22% in 2024 to reach USD 521 billion, outpacing the 20% growth in 2023 and underscoring solar's continued dominance in the energy transition. 22 (See Figure 12.) A major shift in 2024 was the expansion of small-scale PV, which accounted for more than half of total solar PV investment. 23 Pakistan alone installed 12.5 GW of unsubsidised rooftop solar, reflecting a growing trend towards decentralised generation. 24 In Brazil and the United States, despite record capacity additions, solar investment fell due to declining module costs. 25 The falling cost per installed unit meant that even though more solar capacity was added, the total capital expenditure was lower. 26 In the EU, solar investment stagnated as lower electricity prices made residential solar less attractive, limiting adoption in Germany, France and other major European markets. 27

In contrast to solar PV, wind energy investment dropped around 15% in 2024 to its lowest level since 2021. 28 This decline reflects persistent permitting challenges, supply chain constraints and uncertain policy signals in several major markets. During 2023 and 2024, several offshore wind projects in the United States and Europe defaulted due to unhedged costs and revenue-support schemes that were not adapted rapidly to external market conditions. 29 Renegotiations of offtake deals put projects at risk of further delays. 30

x2 cost of capital in emerging and developing economies compared to advanced economies.

The cost of wind energy materials, labour and logistics has increased due to strong demand and constrained supply in the wake of the COVID-19 pandemic. 31 The global economic fallout from the Russian Federation's invasion of Ukraine in 2022 raised overall project capital expenditures for most developers globally. 32 The rising costs of raw materials and components required for turbine production have increased both the manufacturing and upkeep costs that manufacturers need to bear. 33 These price increases have put additional pressure on developers who are already operating with narrow profit margins and are constrained by wider project economics.

The US offshore wind industry has faced a perfect storm of rising costs, permitting delays and grid connection hurdles – all leading to low returns. 34 Inflation and supply chain challenges have driven up capital expenditures, and financing costs have spiralled due to rising interest rates. 35 Some developers have sought to renegotiate their previously agreed offtake deals, which are no longer profitable, while others have tried to cancel their contracts altogether. 36

After a period of relative stagnation, global investment in liquid biofuels increased in both 2023 and 2024. 37 Most of this investment was in hydrotreated vegetable oil (HVO) production capacity, as well as conventional ethanol in Brazil and India.38 In addition to ethanol for road fuel, investments gained momentum in the use of ethanol as aviation fuel (alcohol-to-jet), mainly in the United States.39 Among the leading companies, BP had the largest announced production capacity in its pipeline – a combined 130,000 barrels per day of ethanol and HVO and sustainable aviation fuel (SAF) capacity – positioning BP as a global frontrunner in bioenergy. 40 Other oil majors, including Chevron, Eni, ExxonMobil, Shell, and TotalEnergies, also made large strides, particularly with advanced biofuels, although many projects are still in development. 41

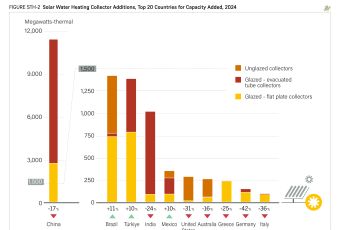

Despite a 7% overall decline in the global solar thermal market in 2023, due mainly to a 7.7% drop in China, notable growth occurred in some areas. 42 In India, also a solar thermal leader, the market grew 27%. 43 Interest has risen as well in southern Africa and Latin America, with solar thermal growth reported in Mozambique (40%), South Africa (12%), Mexico (5%) and Brazil (3%). 44

The rising prominence of nuclear energy presents another shift in the energy investment landscape. This risks diverting capital from renewable energy efforts, potentially crowding out the broader renewables agenda.

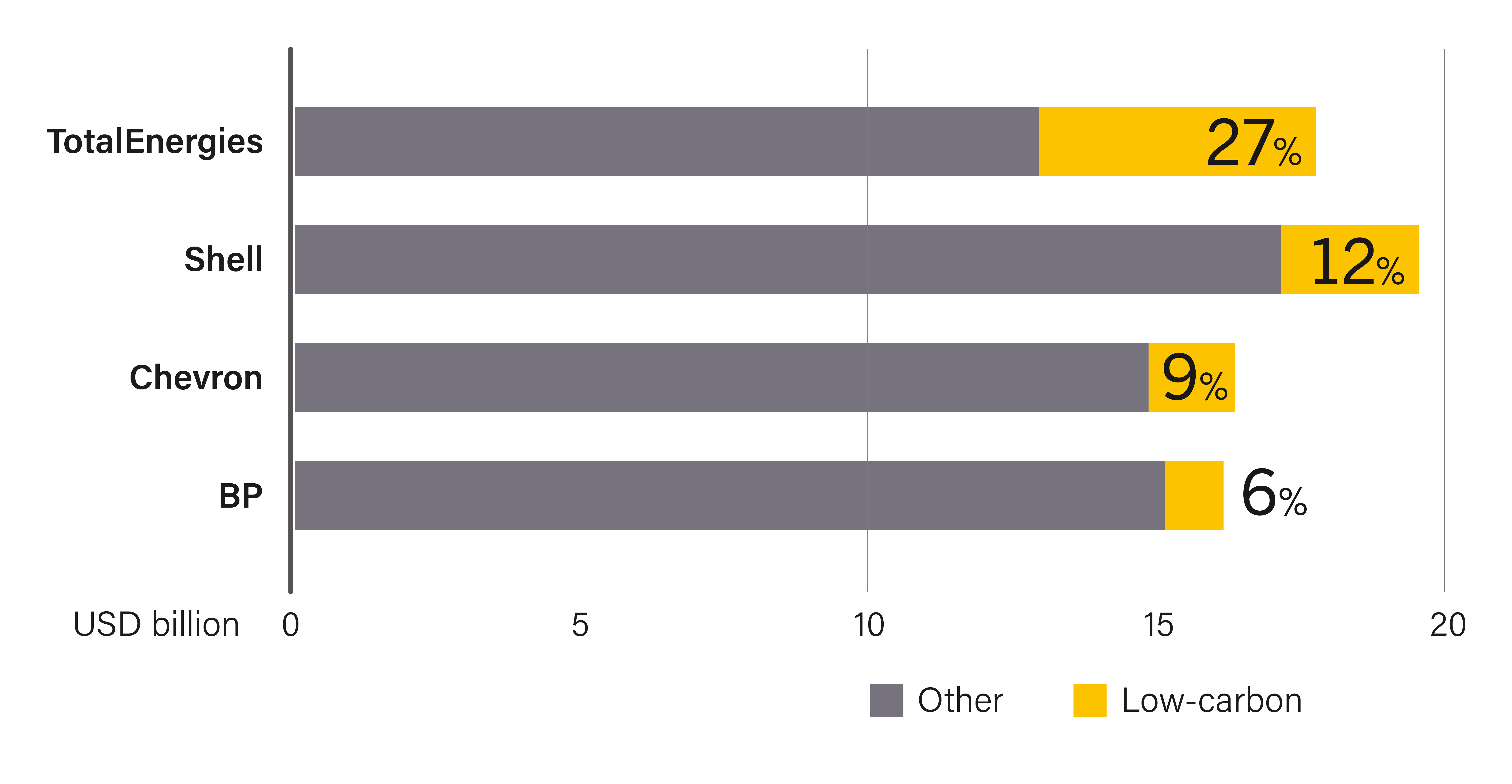

Despite broader market gains, renewable energy companies experienced plummeting stock values in late 2024 amid fears that the incoming US administration could enact policies eroding the competitiveness of renewables. 45 Market dynamics have added to the uncertainty. 46 The demand outlook for renewable energy technologies is clouded by volatile pricing, supply chain overcapacity and investor scepticism. 47 Large energy companies, including BP, have contributed to this trend by scaling back their renewable energy strategies and redirecting investment towards fossil fuels. 48 (See Sidebar 4). Meanwhile, private investors, including major hedge funds, have expressed waning interest in clean energy due to concerns about profitability and political risk, with some declaring that “clean is dead for now”. 49

22% was the growth in solar PV related investment in 2024.

In addition, there has been growing uncertainty about the future availability of international climate finance. Policy shifts – such as the possible loss or redirection of financing for the US Agency for International Development and various climate-related funds – pose a serious threat to renewable energy initiatives in developing countries. 50 A lack of clarity on the future of tariffs and tax credits triggered steep declines in funding and investment for renewables in early 2025. 51

Energy Efficiency and Enabling Technologies

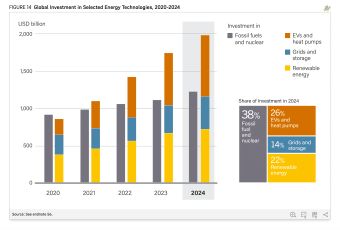

Investment in energy efficiency and enabling technologies was an estimated USD 871 billion in 2024, a 12% increase from 2023. 52 This was driven mainly by a 20% increase in investment in electrified transport i , which reached USD 747 billion and surpassed investment in renewables. 53 Markets for other technologies slowed, with heat pump investments declining 5%, hydrogen falling 42% and clean industry ii plummeting 50%. 54 However, between 2020 and 2024, electrification of end-uses experienced the fastest growth. 55 During the same period, investments in fossil fuels and nuclear energy also grew but at a slower rate; their relative share in total energy investment declined, reflecting a broader trend towards renewable energy and enabling technologies. 56 (See Figure 14.)

FIGURE 12 Global Investment in Renewable Power and Fuels, by Technology, 2015-2024

Global demand for heat pumps weakened in early 2024, although some regions may have reached a turning point. 57 Sales in China grew 13% in the first few months of 2024 – the second consecutive year of double-digit growth – consolidating its position as the largest domestic heat pump market (30% of the global total). 58 In the United States, the second largest market, sales fell 1% in the first half of the year, and in the EU they fell nearly 50%. 59 Factors contributing to the decline in European heat pump sales included falling natural gas prices, a slowdown in the construction sector (with a large share of heat pumps installed in new buildings) and an uncertain political and regulatory landscape. 60

Investment in clean industry projects iv fell nearly 50% in 2024. 61 Clean steel projects took the biggest hit in financial commitments, with investment falling to around USD 17.3 billion, down from USD 40.2 billion in 2023. 62 Green hydrogen made from renewables remained costly and in scarce supply, and some producers (such as Europe's ArcelorMittal) delayed planned investments in hydrogen-based projects. 63 Unlike in 2023, few developers of new clean steel and ammonia facilities allocated capital for “co-located” hydrogen plants and renewable energy installations. 64

Despite these setbacks, clean hydrogen projects – encompassing both renewable and low-carbon sources – reached a major milestone, with final investment decisions (FIDs) rising sharply from 102 projects in 2020 (worth around USD 10 billion) to 434 projects in 2024 (worth around USD 75 billion). 65 The share of total hydrogen investment dedicated to clean hydrogen supply projects also increased, from more than 60% in 2020 to 75% in 2024. 66

Global investment in power grids and energy storage reached a record high in 2024. Grid spending rose 15% to USD 390 billion, with growth across all regions, notably in Europe. 67 Investment in energy storage increased 36% to USD 54 billion, driven largely by developments in Asia and the United States. 68 Despite this progress, investment in grid infrastructure still needs to increase significantly to support the expansion of renewable generation required to achieve net zero greenhouse gas emissions targets by 2050. 69

FIGURE 14 Global Investment in Selected Energy Technologies, 2020-2024

i Electrified transport investment is based on preliminary sales data and estimated prices of electric vehicles, fuel cell vehicles, and electric charging infrastructure and hydrogen refuelling stations. Private charging investment for commercial vehicles is not included.

ii Clean industry investments include investments in bioplastics, circular economy, clean ammonia and clean steel.

iv Clean industry projects include, bioplastics, circular economy, clean ammonia and clean steel.

Renewables in Energy Supply

13.4% share of renewables in TFEC in 2022.

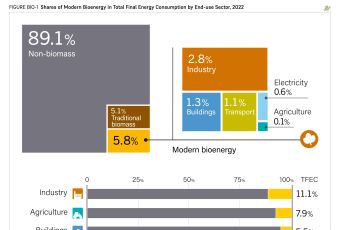

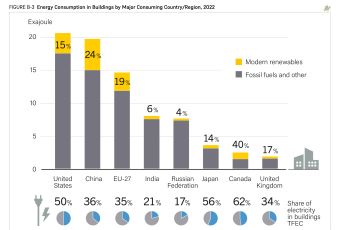

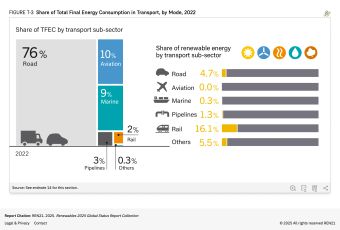

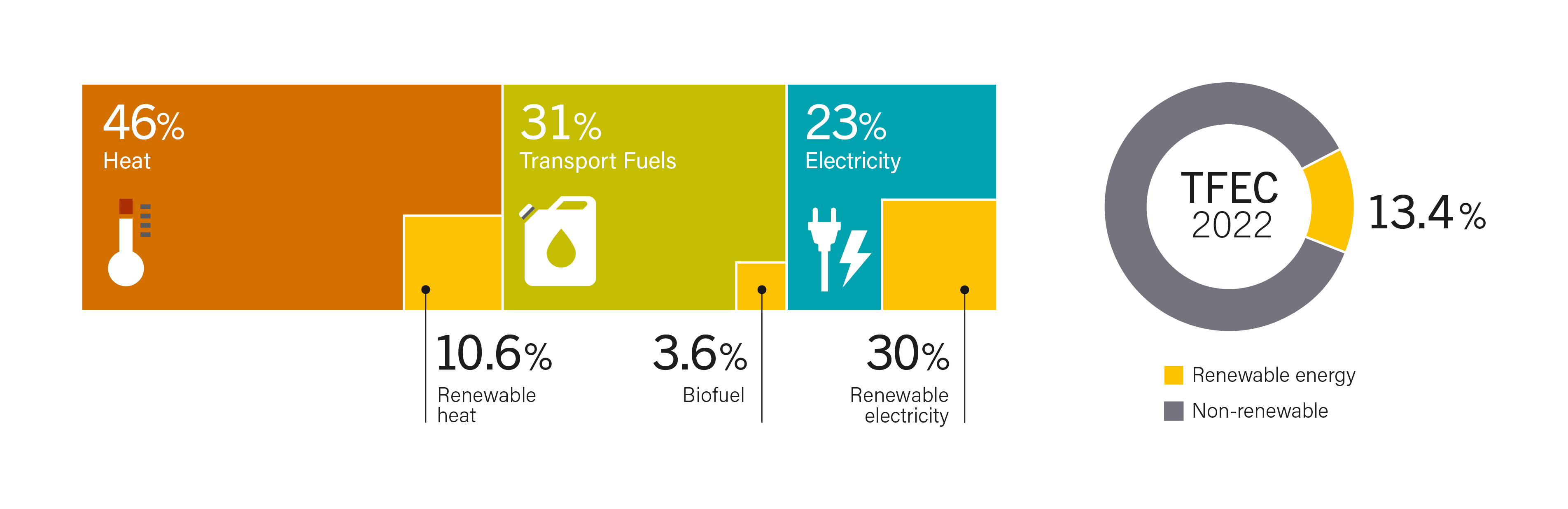

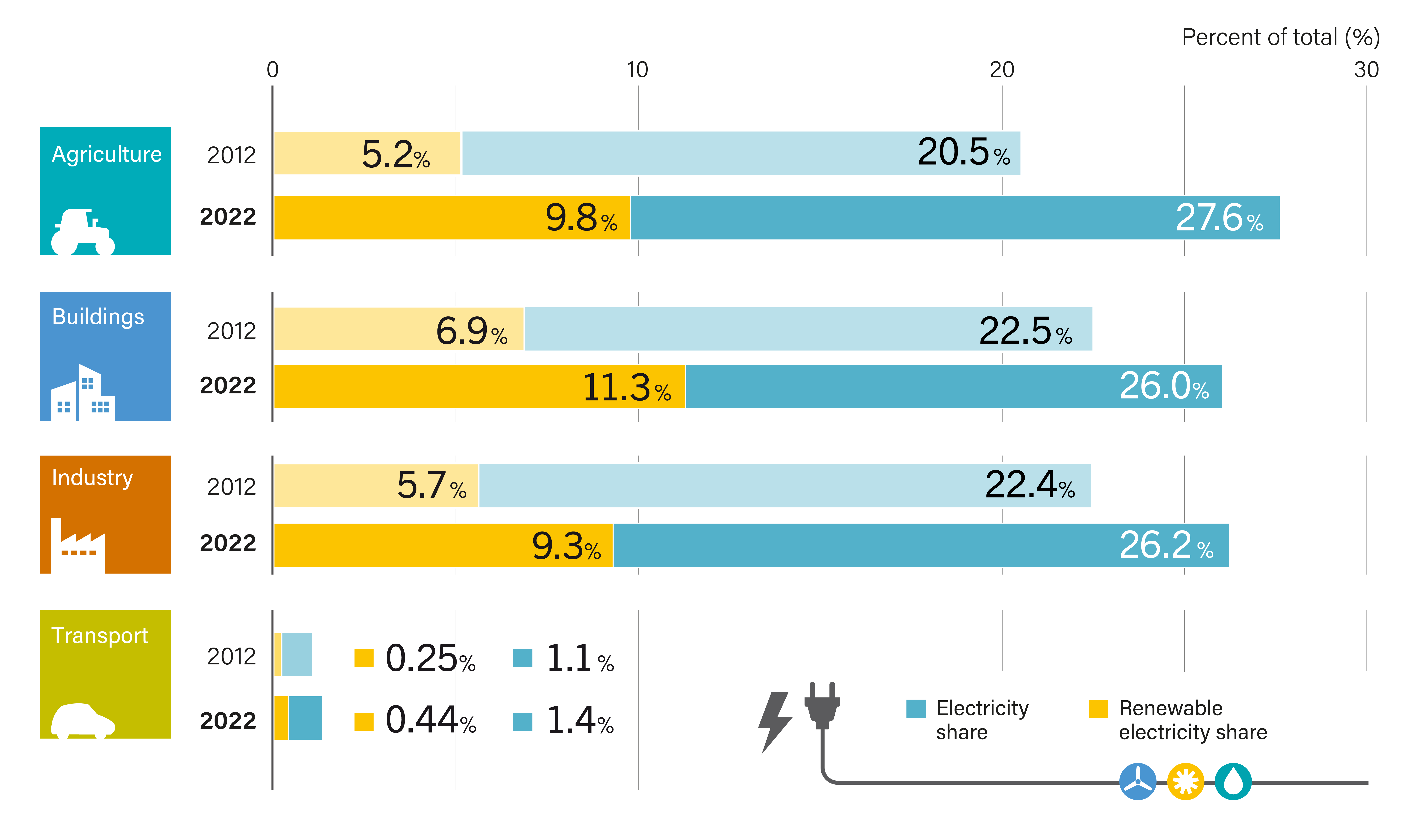

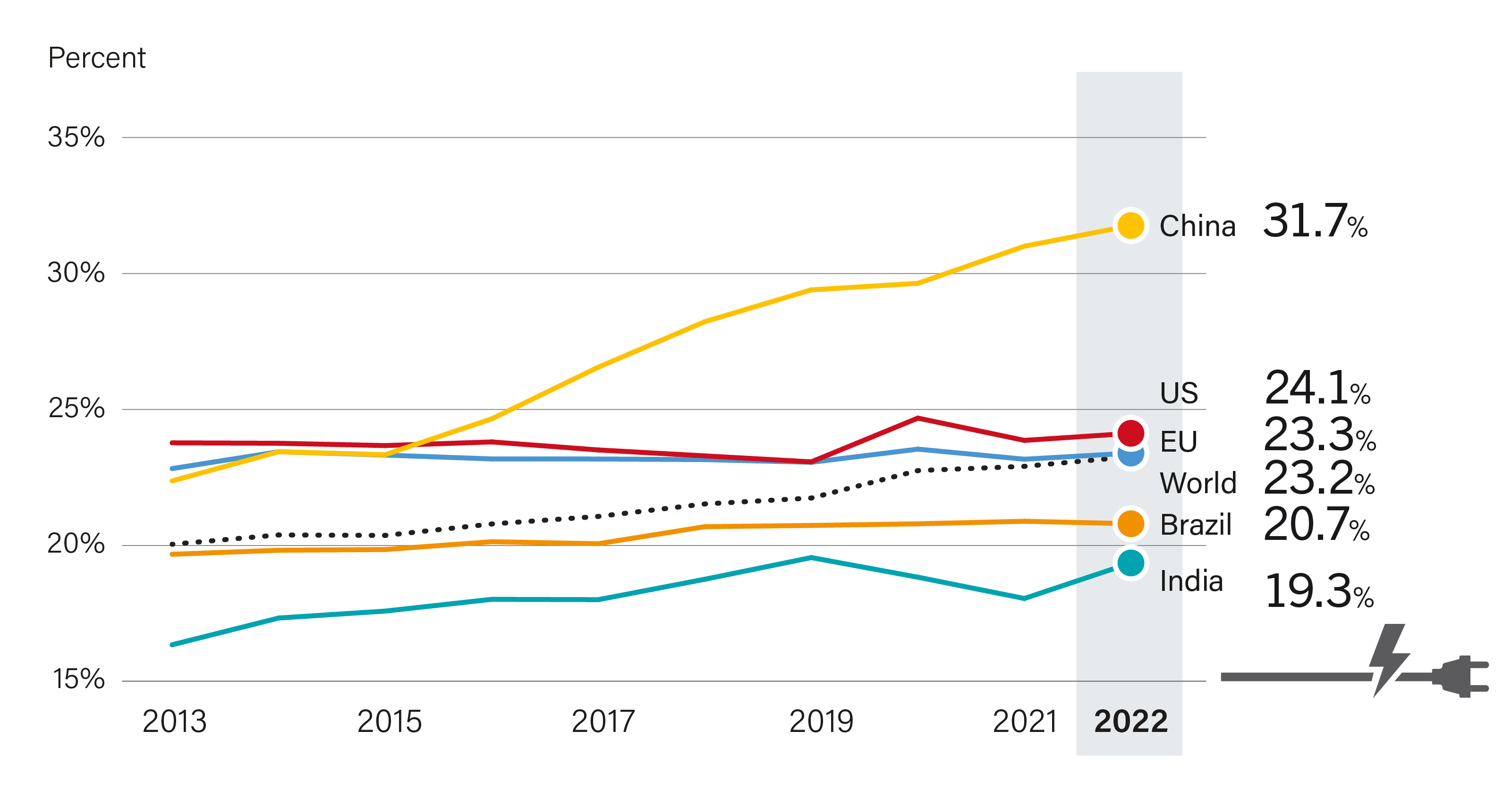

In 2022 (latest data available), modern renewable energy accounted for just 13.4% of global total final energy consumption (TFEC), while fossil fuels continued to dominate across end-use sectors. 1 The breakdown by sector reveals disparities in renewable energy uptake. Although electricity represented only 23% of TFEC, it had the highest share of renewables at around 30% in 2022, up from 23% in 2015, reflecting strong progress in the power sector. 2 (See Figure 15.) In contrast, the heat and transport sectors together accounted for 77% of TFEC (46% and 31% respectively) but lagged in the use of renewable energy. 3 Renewables supplied only 10.6% of the world's heat, and biofuels accounted for just 3.6% of transport fuel use. 4 The world remains a long way from decarbonising heat and transport, which continue to rely heavily on fossil fuels. 5

Renewable Power

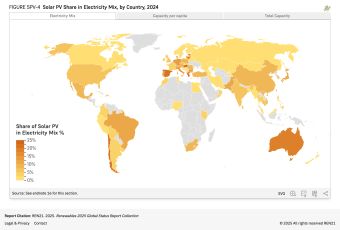

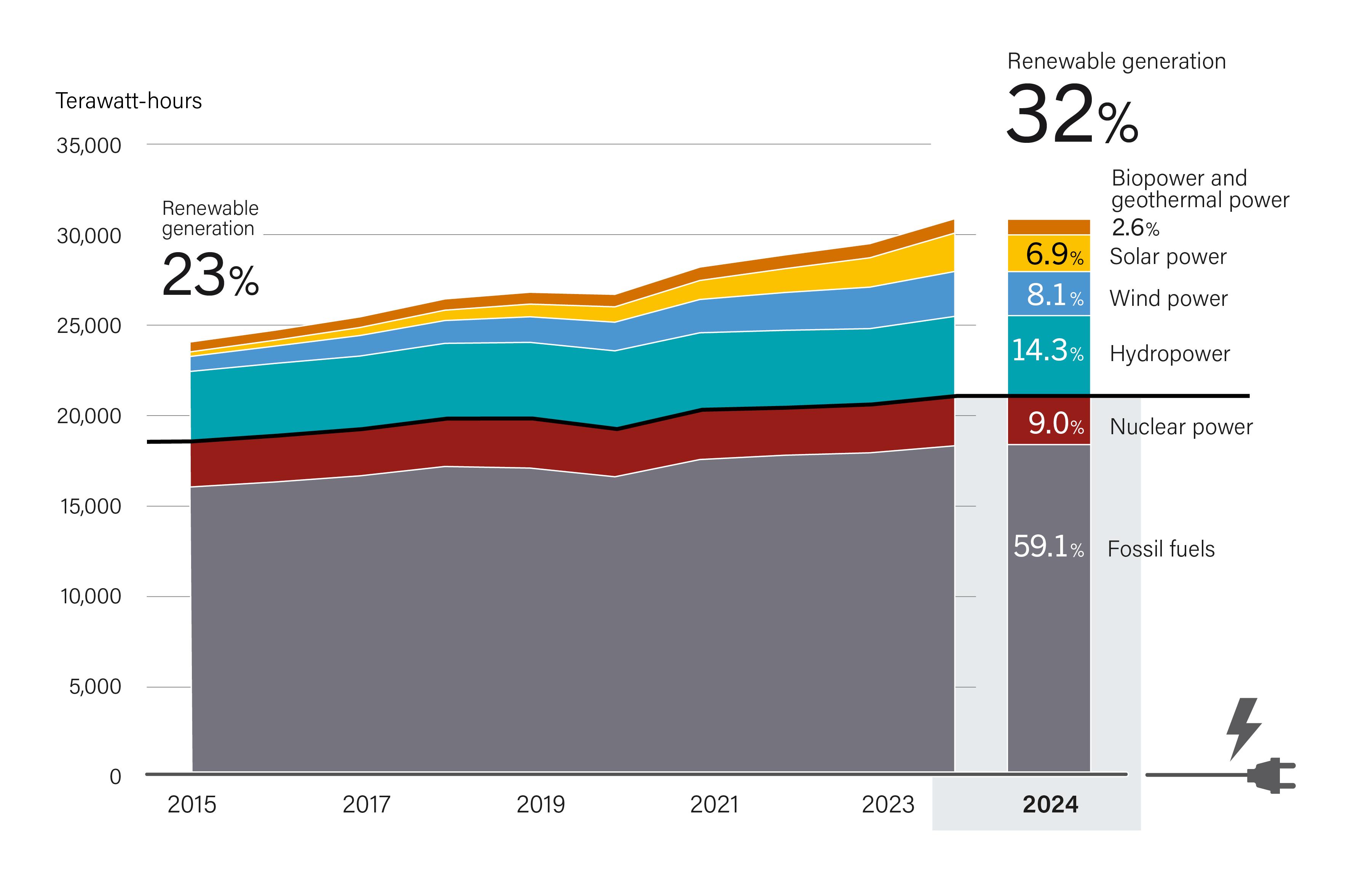

In 2024, global electricity generation reached a record high of around 30.9 thousand terawatt-hours (TWh), with renewables accounting for nearly one-third (31.9%) of the total. 6 (See Figure 16.) Fossil fuels remained the dominant electricity source, generating 18.2 thousand TWh and representing 59.1% of the total, although this share has been declining; nuclear power accounted for the remainder (9%). 7

23% of total final energy consumption is met by electricity.

Hydropower remained the largest source of renewable electricity (14.3% of the total), while wind and solar power saw the most dynamic growth. 8 Between 2015 and 2024, solar power generation increased 16-fold, reaching 2,132 TWh (6.9%), while wind generation rose nearly 4-fold to 2,494 TWh (8.1%). 9 Bioenergy and geothermal power together contributed 800 TWh (2.6%). 10 Thanks to the steady rise in wind and solar generation, renewables are helping to meet rising electricity demand while increasingly displacing fossil fuels in the power sector. 11

FIGURE 15 Total Final Energy Consumption (TFEC) and Share of Modern Renewable Energy, by Energy Carrier, 2022

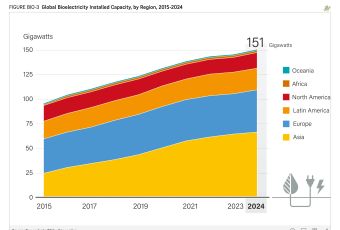

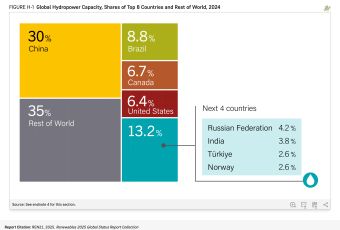

Global renewable power capacity additions totalled 741 gigawatts (GW) in 2024, with China alone accounting for 60.2% (445 GW). 12 (See Figure 17.) Europe contributed 12.4% (92 GW), followed by Asia and Oceania (excluding India and China) with 9.8% (73 GW) and North America with 7.6% (56 GW). 13 India added 36 GW (4.8%) in 2024, while Brazil added 2.4% (18 GW), and the rest of Latin America and the Caribbean added just 1.0% (8 GW). 14 Africa and the Middle East collectively accounted for only 1.7% (13 GW) of renewable power capacity additions. 15 Most growth continued to be concentrated in a few key markets (particularly China), while many regions remain greatly under-represented in the global energy transition.

Solar PV was the clear driver of this growth, accounting for 81% of new capacity additions in 2024, followed by wind power at 16%. 16 (See Figure 18.) Hydropower contributed just 2%, and other renewables – bioenergy, geothermal, concentrated solar thermal power (CSP) and ocean power – accounted for only 1% of newly installed capacity. 17 Solar PV holds a dominant position not only as the most rapidly expanding renewable energy technology, but also as the largest overall source of renewable power capacity.

FIGURE 16 Electricity Generation by Energy Source, 2015-2024

Total cumulative installed solar PV capacity passed the 2 terawatt (TW) mark in 2024, reaching 2.25 TW nearly double the global total in 2022. 18 In 2024 an estimated 602 GW of new capacity was added – up 32% over 2023 –comparable to the cumulative capacity installed globally by 2019. 19 This continued growth was driven by historically important markets such as China (around 60% of the growth), the United States (8%), and India (5%); however, some new entrants were also significant. For example, in Pakistan (3%) solar PV combined with battery systems has become an attractive option for achieving energy autonomy. 20 Pakistan alone installed more solar PV capacity in 2024 than Italy, France and Australia combined. 21

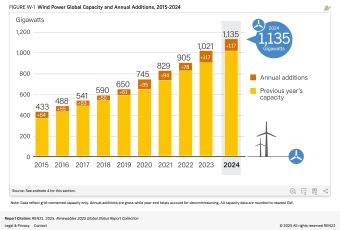

An estimated 116.8 GW i of new wind power capacity was connected to the world's grids in 2024, a record high despite marginal growth (0.2%). 22 Onshore wind installations rose 3.1%, to 109 GW, whereas offshore additions fell 27.5%. 23 China again dominated global wind power additions, accounting for 68.3%; not including China, global additions fell 9.6%. 24 The cumulative wind power capacity in operation grew 11.2% to 1,135.4 GW during 2024. 25 The wind industry had another challenging year, and deployment was slowed by several factors, including political and policy instability, increasing costs and risks, permitting and grid-related challenges, and rising opposition in some key countries. 26 However, installations picked up in some emerging markets, and several countries saw positive policy developments. 27

FIGURE 17 Renewable Power Capacity Additions, by Region/Country

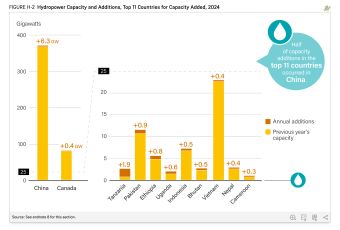

In 2024, hydropower continued to play a central role in renewable electricity generation, with total output reaching an estimated 4,578 TWh. 28 Globally 16.2 GW capacity was added in 2024. 29 China remained the dominant player, adding 6.7 GW of new conventional capacity and maintaining its position as the top hydropower producer, generating more than 1,400 TWh. 30 Other countries that contributed to new capacity additions included Tanzania (added 1.9 GW), Ethiopia (1.2 GW), Bhutan (1.1 GW) and Pakistan (0.9 GW). 31

Capacity in bioenergy, geothermal, ocean power and CSP remained relatively flat, collectively totalling 177 GW. 32 Biopower capacity increased 4.6 GW in 2024, due mainly to new installations in China and France, reaching a global total of 155 GW. 33 Electricity generation from solid biomass power facilities increased globally to 711 TWh, although it fell in Europe with major producers such as Sweden, Finland, Denmark, and the Netherlands seeing reductions, driven by shifts in energy policy, market competitiveness and lower pellet imports. 34

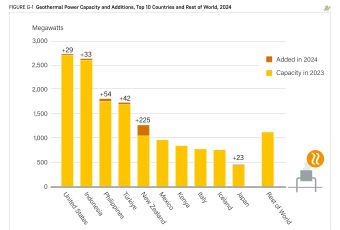

Global geothermal electricity generation reached an estimated 99 TWh in 2024. 35 At least 400 megawatts (MW) of new capacity was added during the year, bringing the total installed capacity to around 15.1 GW. 36 More than half of these additions were in New Zealand, followed by notable developments in the Philippines, Türkiye, Indonesia, the United States and Japan. 37

FIGURE 18 Renewable Power Total Installed Capacity and Additions, by Technology, 2024

+18% annual growth in global renewable capacity in 2024.

Total installed concentrated solar thermal power (CSP) capacity grew by 350 MW to reach 7.2 GW in 2025. 38 The positive dynamics of 2023 continued, with several new projects initiated in China, where the CSP pipeline continued to expand and the first projects of the country's current five-year period were connected to the grid. 39 China's favourable policies for CSP are helping the country to drive the global CSP market. 40

+1,040GW/year needed annually from 2025 to 2030 to meet the global tripling target, nearly 40% higher than the record set in 2024.

For ocean power, the global installed capacity remained relatively unchanged in 2024, with 1.6 MW (net) added. 41 The installed capacity increased by 2.6 MW in the Russian Federation and fell by 1 MW in the Republic of Korea (with downsizing or decommissioning of an existing plant). 42 Policy and investment activity increased compared to previous years. 43

Despite the progress of recent years, at the end of 2024 the world remained far from its collective renewable power capacity target of 11,000 GW by 2030. 44 Meeting this goal will require more than doubling the current installed capacity within just six years, with unprecedented acceleration in deployment. 45 (See Figure 19.)

FIGURE 19 Renewable Power Capacity by Technology, 2019-2024, Compared to 2030 Global Tripling Target

Manufacturing, Labour and Supply Chains

The rapid scale-up in renewable energy deployment has been mirrored by a surge in manufacturing capacity, particularly for solar PV. Global solar manufacturing capacity was expected to exceed 1,100 GW by the end of 2024, nearly double the solar PV demand in 2024. 46 This oversupply has driven module prices down by more than half since early 2023, squeezing profit margins and triggering market instability. 47 In 2024 alone, around 300 GW of polysilicon and 200 GW of wafer manufacturing projects – worth an estimated USD 25 billion – were cancelled. 48 Vulnerabilities in the solar PV supply manufacturing sector have prompted new efforts to strengthen supply chain resilience and diversify sourcing amid growing deployment needs. 49

68% of energy education still focuses on fossil fuels. Only 32% is dedicated to renewables as of 2024.

In the wind sector, uncertainties due to stop-start government policies and unpredictable procurement cycles have created high demand volatility. 50 These factors combined with permitting bottlenecks have led to razor-thin or even negative margins and have rendered investment in the supply chain unviable. 51 In some key regions (Europe, Americas) investment in the supply chain has been insufficient to meet ambitious targets and expected demand beyond the next couple of years. 52 China continued to dominate turbine manufacturing as well as the world's supply chain for critical components and raw materials. 53 Chinese turbine manufacturers represented 6 of the world's top 10 and, for the first time, held the top four spots. 54 While heavily reliant on their home market, China's biggest manufacturers looked to expand sales overseas and opened new factories around the world. 55 Despite record installations and orders, however, intense competition and oversupply of components further reduced profitability for Chinese manufacturers. 56

1,100GW/year global solar PV manufacturing capacity by end-2024. Nearly double current PV demand.

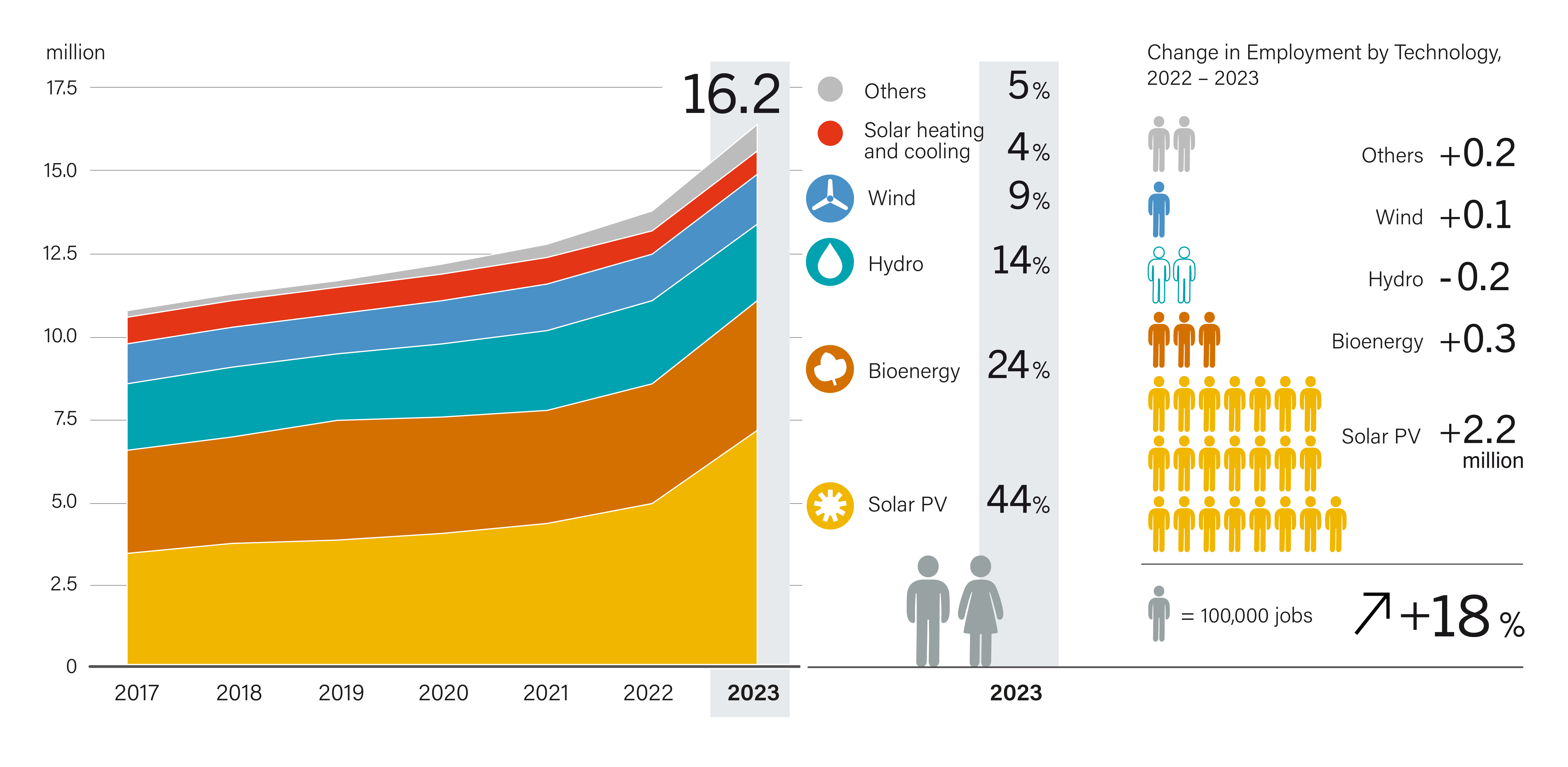

The workforce needed to sustain the energy transition is falling short. 57 Addressing workforce and skills challenges is essential to maintain the momentum of renewable energy growth and to achieve global net zero greenhouse gas emissions by 2050. In 2023, the renewable energy sector employed around 16.2 million people. 58 (See Sidebar 5.)

By 2030, a global shortfall of 7 million skilled workers is projected, particularly in engineering, project management and technical installation roles. 59 The demand for green skillsi is rising much faster than the supply. In 2023, job postings requiring at least one green skill increased 22.4%, while the green talent pool grew by 12.3% across the 48 countries covered in a recent study. 60 This mismatch is compounded by a misalignment in education and training systems. As of 2024, 68% of energy-related degree programmes focused on fossil fuels, with only 32% dedicated to renewables. 61

The fast development of the renewable energy manufacturing industry is increasingly attracting attention to the working conditions along supply chains. Governments, industry players and civil society organisations are looking into safeguards to ensure that the industry develops with respect for worker's rights. Focus is also given to solutions for avoiding or mitigating potential environmental impacts of renewables deployment. 62 (See Sidebar 6.)

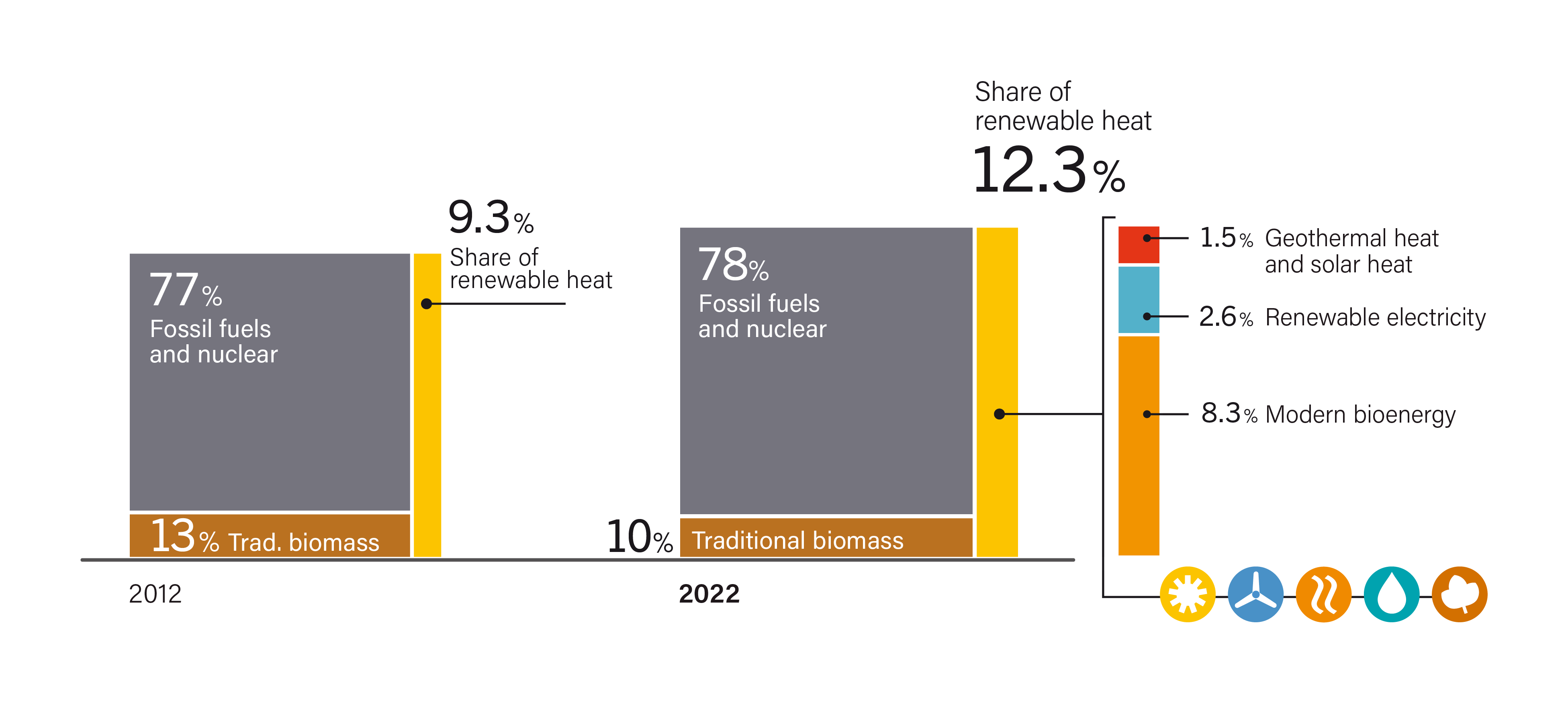

Renewable Heat and Fuels

In 2022 (latest data available), the share of modern v renewable energy in total heat production reached 12.3%. 63 (See Figure 21.) The share of traditional biomass in total heat supply fell to 10%. 64 Meanwhile, fossil fuels remained dominant, maintaining a stable and high share of around 77%. 65

3.2% growth in total renewable heat supply in 2022.

Total renewable heat supply increased 3.2% in 2022. 66 Modern bioenergy provided 8.3% of global heat in 2024, with solid bioenergy playing a major role in supplying district heat networks. 67 The EU led the pellet market, accounting for 44% of production and 50% of consumption in 2023 – mainly for residential use; after years of growth, production stagnated in 2023 because of higher input prices, falling industrial demand and a record warm winter. 68 Renewable electricity for heat grew steadily, highlighting the growing role of electrification in the heat sector. 69 However, direct renewable heating technologies continue to provide only a modest contribution to global heat supply, due in part to limited policy support. 70

FIGURE 21 Share of Renewable Heat Production, by Energy Source, 2012 and 2022

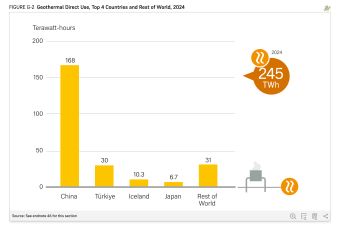

Geothermal heat, which does not include ground-source heat pumps, supplied around 245 TWh (882 petajoules), with China alone accounting for an estimated two-thirds of global geothermal heat output. 71 Due to China's rapid expansion in this sector, the country now produces 43% more geothermal heat than the entire world did in 2019. 72 Among other leading countries, geothermal continued to grow in Türkiye; Iceland saw only modest increases, and Japan experienced a decline. 73

Geothermal Power Plant in Iceland

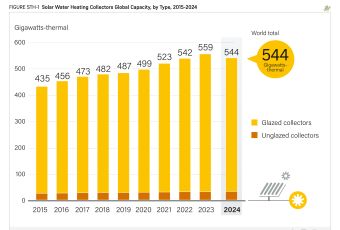

By the end of 2024, solar thermal heating systems were supplying direct heat to millions of residential, commercial and industrial clients in at least 134 countries. 74 The global market for solar thermal water collectors contracted 14.2% in 2024, due mainly to an ongoing decline in China, the largest market. 75 However, during the year, China also commissioned the world's largest solar thermal plant, demonstrating continued investment in large-scale applications despite the overall market decline. 76 (See Snapshot China) Small-scale systems continued to lose market share in several regions, whereas demand grew for large-scale solar collectors (water, air and concentrating systems) – including for district heating systems and industrial process heat – as cities and companies sought to decarbonise their operations. 77 Solar thermal heating technologies continued to face multiple challenges, including market competition due to a lack of awareness and an imbalance in incentives. 78

Toftlund District Heating Solar Park, Denmark

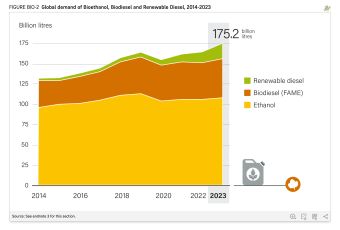

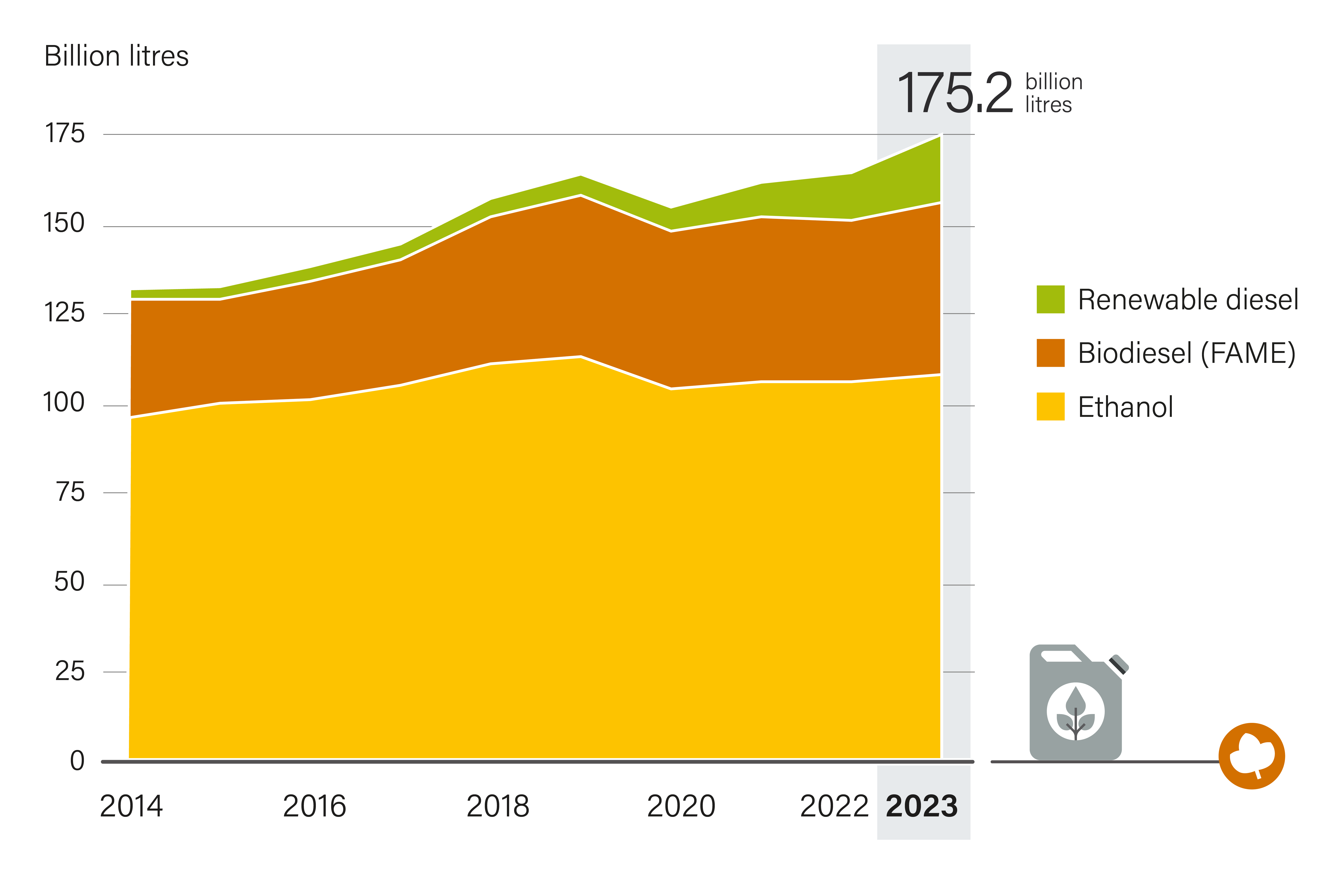

Liquid biofuel production rose 7% in 2023, reaching a total of 175.2 billion litres, led by Brazil, India, Indonesia, and the United States. 79 (See Figure 22.) In 2024, following a full year of B35 implementation – the world's highest national mandate for blending biodiesel in petrol – Indonesia reported palm oil-based biodiesel production of 13 billion litres and consumption of 12.6 billion litres. 80 Ethanol and renewable diesel production hit record highs in the United States, while the EU remained the largest bio-based diesel market despite a decline in Swedish blend mandates. 81 In 2024, Brazil enacted the Fuel of the Future law, setting blending levels for biomethane, higher blending mandates for ethanol (from 22% to 27%, with a potential to reach 35%) and biodiesel (increasing one percentage point annually, starting 2025, to reach 20% by march 2030), and also setting greenhouse gas reduction targets for the aviation sector and a national programme for green diesel. 82 Sustainable aviation fuel (SAF) production grew but still covered less than 1% of aviation fuel demand; in 2024, new SAF mandates in India, Indonesia and the Republic of Korea are expected to drive future growth. 83

FIGURE 22 Global Supply of Ethanol, Biodiesel and Renewable Diesel, 2014-2023

Snapshot CHINA

World's Largest Concentrated Solar Thermal System

Kunlewan International Tourism Resort, which opened in May 2024, is located in Handan city in the northern Chinese province of Hebei. It hosts the world's largest concentrated solar thermal system, with a total of 4,159 solar collectors installed across the 114,000 square metre solar mirror field i . Adjusted by a sun-tracking system, the mirrors focus sunlight onto receiver tubes, heating oil that stores thermal energy at 150-180°C. The heated oil is then piped to the energy conversion system, which supplies heating and cooling for the leisure resort through plate heat exchangers, ammonia absorption chillers and lithium bromide absorption chillers.

Energy generated from the solar system is stored in two types of units: heat storage tanks and cold storage tanks. For system control and management, the energy data control centre connects all equipment across the resort with a tracking system and a distributed control system (DCS) for industrial automation. This enables continuous 24-hour operation, even when unattended. A dedicated system adjusts the project's energy distribution based on varying weather conditions. The space beneath the solar collectors is used as a car park with more than 3,000 parking spaces and over 400 electric vehicle charging stations.

114,422MWh of thermal energy produced annually

This approach enables year-round operation and consistent indoor temperatures, demonstrating how renewables can provide stable, climate-resilient infrastructure for public amenities across all seasons. Kunlewan's four core components – an aquatic recreation centre, indoor ski hall, commercial plaza and hotels – consume around 117,708 megawatt-hours (MWh) of thermal energy annually for water heating, air conditioning, and ice and snow production. The solar mirror field captures around 114,422 MWh per year, meeting up to 97% of the demand and avoiding an estimated 38,000 tonnes of CO2 emissions annually.

As the first demonstration project integrating large-scale renewables in China's tourism sector, Kunlewan is supported by both public entities and the private sector. It is invested and developed by Handan Jianxu New Energy, established jointly by Inner Mongolia Xuchen Energy (the technical supplier and operator of the solar field) and Handan Jiaojian Zhanghe Development Co., Ltd. (a local state-owned enterprise). A total of USD 734.2 million (CNY 5.3 billion) was invested in the project, including USD 165 million (CNY 1.2 billion) ii in corporate bonds issued by Handan Construction Investment Group, a wholly state-owned enterprise.

i The solar thermal capacity of the field is an estimated 77 megawatts.

ii Investment amounts are converted using exchange rates as of April 2024.

Source: See endnote 76 for this section.

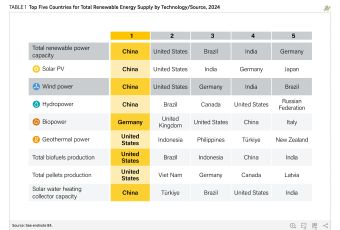

TABLE 1 Top Five Countries for Total Renewable Energy Supply by Technology/Source, 2024

TABLE 2 Top Five Countries for Per Capita Renewable Energy Supply by Technology/Source, 2024

i The data in this section reflect wind power capacity that was newly grid-connected during 2024 and in operation by the end of 2024. Accounting for decommissioning, net additions were an estimated 114.9 GW in 2024. Including more than 9 GW of capacity that was mechanically installed in China, India and the United States, but not necessarily grid-connected, global wind power additions in 2024 were closer to 127 GW. “Mechanically installed” refers to capacity that is in place and ready to produce electricity but not officially connected to the grid. See endnote 22 for this section.

ii Green skills refer to the abilities that support environmentally sustainable practices, including those related to energy efficiency, renewable energy, waste reduction, and environmental conservation.

iii Modern renewable energy in total heat production includes modern bioenergy, renewable electricity, geothermal heat and solar heat. It excludes traditional biomass used for heating.

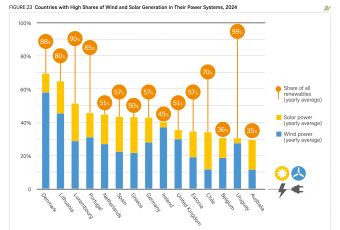

Energy Systems and Infrastructure

In 2024, the power sector continued to spearhead the adoption of renewable energy. During the year, 33 countries generated more than half of their electricity from renewable sources, and 15 countries successfully integrated more than 30% variable renewable electricity – solar and wind power specifically – into their electricity mix. 1 (See Figure 23.)

The power system infrastructure is evolving to support the upward trend of electrification and the integration of more distributed and variable renewable electricity into the world's grids. 2 In 2024, in addition to reinforcing and expanding transmission networks and interconnections, regulators and system operators increasingly focused on flexibility measures – including energy storage, demand response and the use of digital technologies – to ensure grid stability and reliable supply. 3

FIGURE 23 Countries with High Shares of Wind and Solar Generation in Their Power Systems, 2024

Electricity Grids

The optimisation and expansion of power networks continued to attract investment and policy attention in 2024, with total grid investment reaching USD 390 billion, up 15% compared to 2023. 4

At the November 2024 United Nations Climate Change Conference in Baku, Azerbaijan (COP 29), 65 countries signed the Global Energy Storage and Grids Pledge, committing to deploy 1,500 GW of energy storage and to develop or refurbish 25 million kilometres of grid infrastructure by 2030. 5 Additionally, 57 countries endorsed the Green Energy Zones and Corridors Pledge, which aims to accelerate the development of renewable energy and transmission infrastructure through international co-operation. 6

390USD billion total grid investment in 2024.

Meanwhile, challenges with grid congestion and connection queues continued. As of mid-2024, an estimated 1,650 GW of renewable energy capacity in advanced development stages was awaiting grid connection, up 150 GW from a year earlier. 7 Interconnection queues in the United States expanded 30% in 2023, with connection timelines tripling over a two-decade period to around five years from the request date to the commercial operation date. 8

In China, despite record investment of USD 17 billion in the first four months of 2024, power grids struggled to keep pace with wind and solar capacity additions. 9 Many counties and cities across five Chinese provinces suspended their approvals for connecting new small-scale solar projects to distribution grids during the year. 10

In the EU, to compensate for grid congestion, system operators engaged in remedial actions i covering an estimated 57.3 TWh in 2023, up 14.5% compared with 2022. 11

Policy interest has grown in pursuing system upgrades and flexibility through battery storage, demand-side response, sector coupling, the use of distributed resources and the integration of new actors such as aggregators and local energy communities in power system design. 12 Policies include mandatory long-term grid planning as well as provisions to streamline permitting, give priority status to grid expansion projects, and prioritise grid optimisation and flexibility solutions prior to grid expansion. 13 Several countries have mandated that new variable renewable energy capacity be paired with storage capacity. Market instruments such as variable network tariffs and constraint markets have emerged as tools to balance power networks. 14 (See Snapshot United Kingdom)

Grid-enhancing technologies – such as Dynamic Line Rating and Advanced Power Flow Control – progressed from pilot projects to operational deployment in 2024, and many are being integrated into utility planning and regulatory frameworks. Regulators and regional authorities (such as the US Federal Energy Regulatory Commission and the US state of Minnesota) have increasingly required the use of these technologies on transmission lines

to improve grid efficiency. 15 Utilities worldwide are deploying operational grid-enhancing technologies, including National Grid in the US state of New York, Red Eléctrica de España (REE) in Spain, the German-Dutch transmission system operator TenneT, ISA Energia in Brasil and ISA Transelca in Colombia. 16

To ensure the integration of higher shares of variable renewables – such as solar and wind power – technologies such as grid-forming batteries and inverters and the provision of virtual inertia have increasingly been integrated in grid modernisation strategies, along with demand response measures and improved forecasting. 17 Examples include the Grid Modernization Strategy of the US Department of Energy, the Inertia Report of the Australian Energy Market Operator, the System Stability & Resilience innovation priority of the UK's National Energy System Operator, the Roadmap for an Accelerated Energy Transition of Chile's power coordinator, the recommendations of the Grid Controller of India, and Eskom's (South Africa) inertia estimation tool in collaboration with the Global PST Consortium. 18

Regional interconnection projects advanced in 2024. In Africa, these included the completion of the cross-border transmission project between Burundi, Rwanda and Tanzania; the securing of funding for an interconnection line between South Sudan and Uganda; and the announcement by Eastern Africa Power Pool countries of their launch of an intraday electricity market in 2025. 19 To the north, funding for the ELMED interconnection project between Tunisia and Italy advanced through a loan from the European Investment Bank, and an interconnection line between Iraq and Türkiye started operating. 20

In South America, Ecuador and Peru launched a tender for a new interconnector, and in Central Asia, Azerbaijan, Kazakhstan and Uzbekistan signed a memorandum of understanding to connect their power systems through an undersea high-voltage cable. 21

Snapshot: United Kingdom

Local flexibility Market to tackle grid bottlenecks

Constraints refer to limitations in the transmission network that lead the system operator to force electricity producers to reduce their output in instances where generation is higher than the network's capacity. In recent years, grid constraints have been notable in the UK, especially between Scotland and England. The costs of these constraints – paid by the National Energy System Operator (NESO) – USD 2.2 billion (GBP 1.6 billion) for the financial year 2022-2023 i .

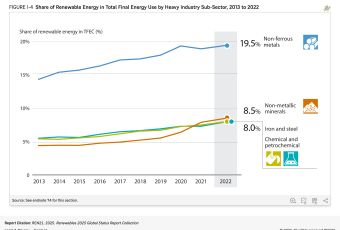

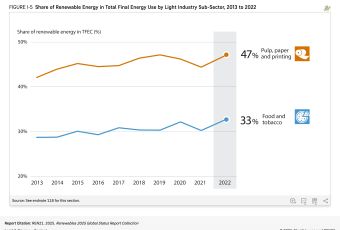

As part of the strategy to address these rising costs over the short term, NESO has set up the Local Constraint Market (LCM), wherein electricity users and producers in specific areas propose bids to increase or decrease their electricity use or generation at certain times. The market was designed to be open to a wider range of participants than the traditional Balancing Mechanism (BM), NESO's main tool to maintain real-time balance between electricity supply and demand. The BM works on an “intraday” basis by asking generators or consumers to adjust their output every half hour. Only participants formally registered in the BM can take part.